Startups now understand what they should be doing in their early formative days is search for a business model. The process they use to guide that search is “Customer Development”; and to track their progress startups now have a scorecard to document their week-by-week changes – the business model canvas.

Yet even with all these tools, early stage startups still need to physically meet with advisors and investors. That’s great if you can get it. But what if you can’t?

What’s missing is a way to communicate all this complex information and get feedback and guidance for startups who cannot get advice in a formal board meeting.

Steve Blank is a retired serial entrepreneur, educator, thought leader and creator of the rigorous “Customer Development” methodology that helps startups optimize their chances for success while reducing risk. The process, which Blank detailed in his book, “The Four Steps to the Epiphany,” uses customer feedback to refine and improve a product before scaling a business. Blank teaches entrepreneurship at Stanford University and UC Berkeley and blogs at steveblank.com.

We propose that early stage startups communicate in a way that didn’t exist in the 20th century: online, collaboratively, through blogs.

We suggest that the founders/CEO invest one hour a week providing advisors and investors with “Continuous Information Access” by blogging and discussing the progress of their startup’s search for a business model online. They would:

- Blog their Customer Development progress as a narrative

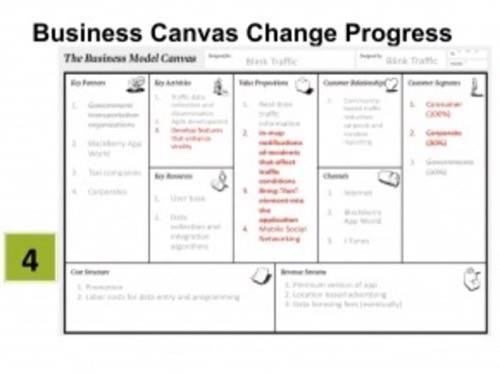

- Keep score of strategy changes with the Business Model Canvas

- Comment/dialog with advisors and investors on a near-realtime basis

What Does This Change?

Structure: Founders operate in a chaotic regime. So it’s useful to have a structure that helps “search” for a business model. The “boardroom as bits” uses The “boardroom as bits” uses Customer Development as the process for the search and the business model canvas as the scorecard to keep track of the progress, while providing a common language for the discussion.

This approach offers VCs and angels a semi-formal framework for measuring progress and offering their guidance in the “search”? for a business model. It turns ad hoc startups into strategy-driven startups.

Asynchronous Updates: Interaction with advisors and board members can now be decoupled from the – once every six weeks, “big event” – board meeting. Now, as soon as the founders post an update, everyone is notified. Comments, help, suggestions and conversation can happen 24/7. For startups with formal boards, it makes it easy to implement, track and follow-up board meeting outcomes.

Monitoring and guiding a small angel investment no longer requires the calculus to decide whether the investment is worth a board commitment. It potentially encourages investors who would invest only if they had more visibility but where the small number of dollars doesn’t justify the time commitment.

A board as bits ends the repetition of multiple investor coffees. It’s highly time-efficient for investor and founder alike.

Coaching: This approach allows real-time monitoring of a startup’s progress and zero-lag for coaching and course-correction. It’s not just a way to see how they’re doing. It also provides visibility for a deep look at their data over time and facilitates delivery of feedback and advice.

Geography: When the boardroom is bits, angel-funded startups can get experienced advice – independent of geography. An angel investor or VC can multiply their reach and/or depth. In the process it reduces some of the constraints of distance as a barrier to investment.

Imagine if a VC took $4 million (an average Series A investment) and instead spread it across 40 deals at $100K each in a city with a great outward-facing technology university outside of Silicon Valley. In the past they had no way to monitor and manage these investments. Now they can. The result – an instant technology cluster – with equity at a fraction of Silicon Valley prices. It might be possible to create Virtual Valley Ventures.

We Ran the Experiment

At Stanford our Lean Launchpad class ran an experiment that showed when “the boardroom is bits” can make a radical difference in the outcome of an early stage startup.

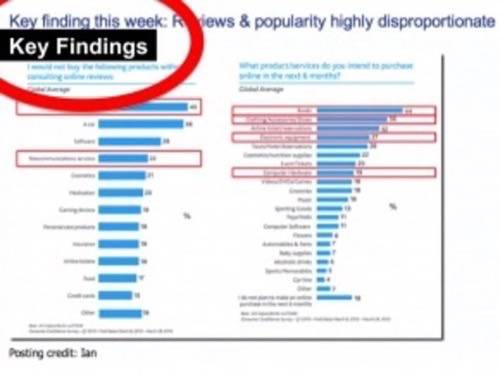

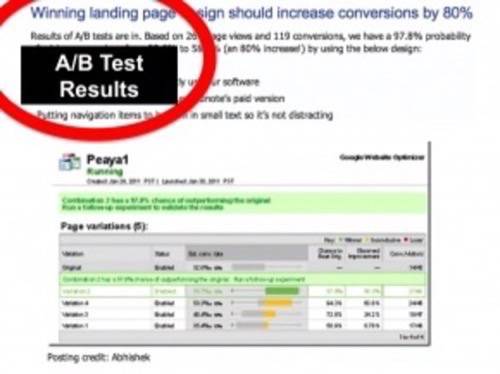

Our students used Customer Development as the process to search for a business model. The used a blog to record their customer learning and their progress and issues. The blog became a narrative of the search by posting customer interviews, surveys, videos and prototypes. They used the Business Model Canvas as a scorekeeping device to chart their progress. The result invited comment from their “board” of the teaching team.

Here are some examples of how rich the interaction can become when a management team embraces the approach.

We were able to give them near real-time feedback as they posted their results. If we had been a board rather than a teaching team we would have added physical reality checks with Skype and/or face-to-face meetings.

Show Me the Money

While this worked in the classroom, would it work in the real world? I thought this idea was crazy enough to bounce off a five experienced Silicon Valley VC’s. I was surprised at the reaction – all of them want to experiment with it. Jon Feiber at MDV is going to try investing in startups emerging from universities with great engineering schools outside of Silicon Valley that have entrepreneurship programs, but minimal venture capital infrastructure. (The University of Michigan is a possible first test.) Kathryn Gould of Foundation Capital and Ann Miura-Ko of Floodgate also want to try it.

Shawn Carolan of Menlo Ventures not only thought the idea had merit but seed-funded the LeanLaunchLab, a startup building software to automate and structure this process. (More than 700 startups signed up for the LeanLaunchLab software the day it was first demo’d.) Other entrepreneurs think this is an idea whose time has come and are also building software to manage this process including Alexander Osterwalder, Groupiter and Angelsoft. Citrix thought this was such a good idea that their Startup Accelerator has offered to provide GoToMeeting and GoToMeeting HD Faces free to participating VC’s and startups. Contact them here.

Summary

For startups with traditional boards, I am not suggesting replacing the board meeting – just augmenting it with a more formal, interactive and responsive structure to help guide the search for the business model. There’s immense value in face-to-face interaction. You can’t replace body language.

But for Angel-funded companies I am proposing that a “board meeting in bits” can dramatically change the odds of success. Not only does this approach provide a way for founders to “show your work” to potential and current investors and advisors, but also it helps expand opportunities to attract investors from outside the local area.

Lessons Learned

- Startups are a search for a business model

- Startups can share their progress/get feedback in the search

- Weekly blog of the customer development narrative

- Weekly summary of the business model canvas

- Interactive comments and questions

- Skype and face-to-face when needed

- This may be a way to augment traditional board meetings

- This might be a way to rethink our notion of geography as a barrier to investments

Read the first post – What’s Wrong With Today’s Board Meetings?