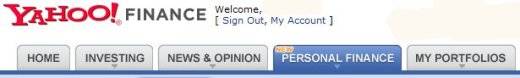

Yahoo! launched its Personal Finance site earlier this

year, on January 19, 2007. In this piece, we will analyze the site based on my Web 3.0

framework.

Yahoo Personal Finance is a

part of Yahoo! Finance and has nine

sub-categories. The site provides financial information, tools, and advice on personal

financial management. The sub-categories of Yahoo Personal Finance are:

- Banking & Budgeting

- Career & Work

- College & Education

- Family & Home

- Insurance

- Loans

- Real Estate

- Retirement

- Taxes

Context: A+

Yahoo! Personal Finance provides sub-categories under the broad categories.

For example Retirement has been

further broken down into four categories:

This provides better context to a person who is looking for retirement

planning.

However note that Yahoo! has not clubbed Stocks, Mutual Finds, Bonds, Research under

Personal Finance, but has included them under Investing – as they appeal to a much

broader financial community than only those who are concerned with personal finance.

Content: A+

Content has always been Yahoo’s strength and the Personal Finance site is no

exception. The website has numerous (66!) finance tools, including Financial Calculators, Experts, Glossary, Rates. It also has 48 How-to Guides.

With its Personal Finance

website, Yahoo has managed to differentiate itself in content from the likes of Google Finance. Yahoo! Personal Finance has

25 partners for financial content, including CNNMoney, Lightbulb Press, Kiplinger, The Motley

Fool, Smart Money and the Wall Street Journal. So Yahoo! has done a

wonderful job on the content front. [Ed: no RSS feeds though?!]

Commerce: B

Yahoo Personal Finance

doesn’t provide any transaction, banking or bill payment facilities. HoweverYahoo! Finance provides the

Yahoo! Real-Time Package on a subscription basis and Yahoo! Finance Research Reports on a ‘pay

per download’ basis.

Yahoo could really beef up the transactional elements of the site, by tying into banks

and brokerage accounts – so that users don’t ever have to leave the site to

transact.

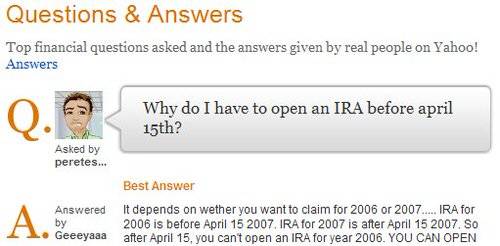

Community: B-

Community has been Yahoo’s sore point and the Personal Finance website lacks any

major community feature – i.e. features which allow social interaction or discussion on

personal financial matters. What they have done is incorporate Yahoo! Answers into the Personal Finance section,

which allows users to ask relevant questions regarding their personal finance – and

answers are then given by real people.

However the Community section needs more punch and Yahoo should incorporate many more

community features – like discussion forums, SIGs (Special Interest Groups), investment

clubs, etc. – on financial matters on the various sub-categories. They need to do this to

attract eyeballs and keep visitors hooked on the website.

Personalization: B

The site allows personalization through My Yahoo, and allows users to customize the

homepage to display their portfolio and track the performance of their

investments.

Again, the Personalization offering is nominal and it could be enhanced hugely. The

holy grail would be to offer personal financial advisors – which may be implemented via

an expert system, or by offering human advisors for a fee. Tying up with private banks

may be another way to go, to make their PCS advisors available to Yahoo’s

customers.

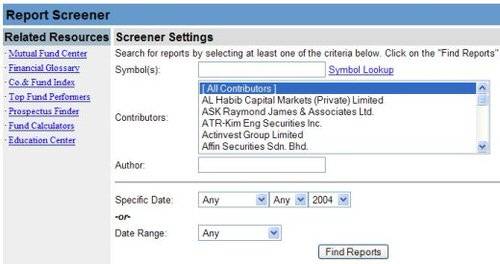

Vertical Search: B

Yahoo! Finance allows a decent search function

and provides screening facilities, which allow users to screen stocks by using various parameters

like share price, market cap, sales revenue, industry, profit, etc. The company provides

similar screening facilities for mutual funds, stock research and bonds.

This function, however, could also be enhanced to include context-specific search

capabilities – for example, college tuition costs for specific colleges.

Business Model

Yahoo earns around 88% of its revenues from the advertisements posted on its web

properties. So in that respect the new personal finance site has broadened its

reach.

The incentive which drove Yahoo! to launch a personal finance site, is the demand by

advertisers to reach out to end-users in the middle of making financial decisions. Yahoo

had previously sold out its advertising inventory for the finance site and therefore

analysts expect Yahoo to generate substantial advertising revenues from this new site.

Yahoo personal Finance has already signed up ETrade, LendingTree, Intuit

TurboTax, Progressive Direct, and Quicken Loans as advertisers.

Conclusion: A+ for content/context, B for commerce/personalization/etc

Overall my rating of Yahoo Personal Finance, using the categories from my Web 3.0 framework, is as

follows: Context : A+, Content : A+, Commerce : B, Community : B-, Personalization : B,

Vertical Search : B.

Do you agree? What are your thoughts on Yahoo Personal Finance?

For more on this topic, see Sramana’s post Personal Finance & Web 3.0 : Overview.