There’s a market for buying handmade baby goods with Bitcoin, and at least one innovative mom-and-pop shop has swooped in to fill that need.

For the United Kingdom’s Cozee Baby, business is booming. Since Kasia Styczynska and her software developer husband, Maciej began accepting the popular cryptocurrency, Maciej said Bitcoin payments are second only to PayPal.

In a world where even world governments aren’t sure what to make of Bitcoin, navigating the world of digital payments was at first difficult for such a small family shop. It took a lot of time and effort not just for the couple, but for customers who were sometimes unfamiliar with Bitcoin. Still, Styczynska was quick to say “it pays off very quickly.”

“We perceive Bitcoin as an innovation and hoping that more and more people will be conversant with Bitcoin payments every day requiring less and less time on our side to support it,” he said.

Bitcoin’s Allure for Small Business

The Styczynskas are part of a tiny but growing trend of small businesses that accept Bitcoin. SpendBitcoins and the Bitcoin Yellow Pages list hundreds of local shops that name Bitcoin as an accepted payment method. By popular request, the unofficial Bitcoin wiki includes a tutorial about how small businesses can implement a Bitcoin payment system.

According to Jerry Brito, a senior research fellow at George Mason University’s Mercatus Center, the major draw comes down to revenue.

“Bitcoin can be cheaper and faster over commercial payments than PayPal. It’s cheaper than Visa or MasterCard. If you’re a small business merchant and want to accept electronic payments, you first have to apply to join the network—and yes, there’s an application fee. If you get accepted, each swipe of any credit card you take costs you 0.25 cents. In addition, you have to return three to six percent of the sales total to the credit card company. That’s a lot off the bottom line, especially for a small business.

“With Bitcoin, you don’t need permission to start accepting it. And fees [which go to Bitcoin miners, to help run the network] are less than one percent.”

While a complicated new currency isn’t set to help out big box stores, to small businesses that hang their livelihood on the bottom line, any way to retain more of a profit is likely worth a shot.

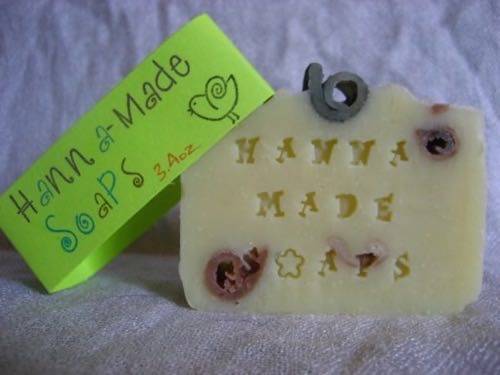

For Ashley Hanna of Hanna-Made Soaps, it came down to reaching more people, more cheaply, no matter where her buyers were coming from.

“Bitcoin is advantageous in that it is one exchange rate all over the world—not like when you pay for something online in the US with a credit card from Canada, get your statement and it’s that much more of a charge for the exchange rate,” she said. “Bitcoin can be sent to your wallet basically instantaneously, no holds, no fees.”

Bitcoin Trending

One part of the appeal of Bitcoin, to be sure, is using cutting-edge technology to stand out from the crowd. All of the small businesses I spoke to were enthusiastic about the attention becoming a Bitcoin vendor had been getting them.

For Michelle Larson-Sadler of Conscious Cookery, right now it’s less about profit than hype.

“I am still waiting for my first customer [that pays in Bitcoin], but the interest is growing week by week,” she said.

Conscious Cookery is a sustainable foods shop that uses Bitcoin as a marketing draw. Larson-Sadler said she got interested in Bitcoin through her husband, an IT operations analyst. He configured her website to accept the currency. Starting this November, the pair will also accept Bitcoin in person at the local farmer’s market using smart phones.

“It’s obvious that the United States dollar has become weaker and weaker as a player in the global economy and people are searching for options other than paying with dollars and cents,” she said. “I feel that we are on the edge of something really new as the economy continues its sluggish trend.”

When Boris Zekster opened Puppy Paws, a boutique pet store in Queens over the summer, he decided to support Bitcoin from the get-go. He asked his brother Alex, a developer with a speciality in encryption, to help him set it up.

“I just think it doesn’t hurt, to be honest with you,” said Boris. “I like the whole idea of Bitcoin. I believe it’s the future of money.”

Pioneering Through Difficulties

So far, Boris has sold one Maltese puppy to a customer paying in Bitcoin. The customer was a family friend just as interested in the currency as the brothers are. Alex used Bitcoin resource Coinbase in order to determine an accurate price.

“We sold that dog for $1,100 and converted the price to Bitcoins in real time,” Alex explained. Because of the fluctuation of Bitcoin compared to cash, we base our prices on the dollar.”

Since Bitcoin is less stable and less supported than other forms of fiat currency, each business has had its own pains setting it up. In every case, the entrepreneur had a tech-savvy relative, spouse or consultant set up the actual Bitcoin mechanics.

“My brother still kind of doesn’t understand the concept,” said Alex. “That’s the thing for the regular person–it gets a little technical and people don’t feel comfortable trusting their money yet to something they cannot touch or see.”

Likewise, the Styczynskas found themselves spending a lot more time with customers than they might have if they were receiving credit card payments.

“The biggest is disadvantage of Bitcoin is that learning curve is quite steep,” said Styczynska “It’s a new thing and one has to read a lot about payments in Bitcoins or delegate these duties to a third-party company. Customers are often not familiarized with Bitcoin payments and sometimes time we need to invest a lot more time per transaction than we would if other payments methods were used.”

Why bother? For the business owners I spoke to, it’s not just about better rates. According to Larson-Sadler, it’s a way for small businesses to take a stand.

“It is the middleman such as a bank, a distributor, that drives up the price of goods. Once we start to choose to initiate a shift to accept a currency without the middleman, prices will start to go down,” she said.

“When small businesses start to accept Bitcoin as a method of payment, it will make a statement to move money away from the banks and from big box businesses—at least for now, until they catch on.”