Two new reports released from Forrester explore the state of video in the enterprise. “Information Workers Are Not Quite Ready For Desktop Videoconferencing” tells us that most workers polled do not want to use desktop video conferencing. Meanwhile, the “TechRadar For Content & Collaboration Professionals: Enterprise Video, Q1 2011” report looks at video in general across the enterprise.

“Although video hasn’t yet taken hold as the way we communicate or work, it will play an important role in connecting the increasingly distributed workforce,” says the Radar report. The reports authors cite research showing that 46% of information workers are expected to be telecommuters by 1016.

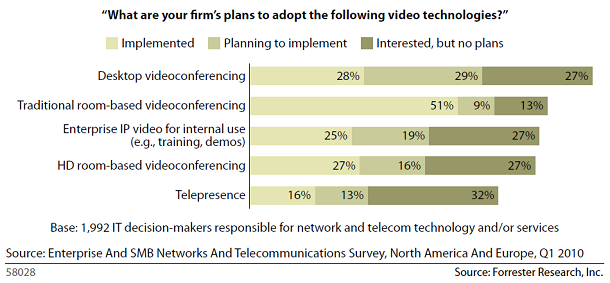

Forrester’s workforce employee survey found that 72% of the 5,519 respondents don’t want desktop videoconferencing at work. The research finds that upper management is driving videoconferencing adoption in the workplace. Those workers that do want video conferencing at work say they want it for routine internal communications such as meetings, but also envision it being used for distance learning and brainstorming.

The Tech Radar report focuses on nine video and video-related technologies. Each technology has business uses and has enterprise-grade products available. The report classifies the nine technologies into three phases: creation, survival and growth. None of the technologies has yet reached the “equilibrium” or “decline” phases of the Tech Radar model.

Creation Phase

Mobile videoconferencing: Desktop videoconferencing has yet to catch-on, but mobile videoconferencing is already emerging. It’s not companies like Qik and Skype – established companies like Polycom and Tango are getting in on mobile as well. The report notes “Although cell phones with cameras and video calling plans have been around since 2003, mobile videoconferencing is less mature than other technologies in this report and remains unproven in the market.”

Survival

Desktop videoconferencing: Despite having been around for years, desktop videoconferencing remains stuck in the “survival” phase.

Enterprise video platforms (EVPs): These are the sorts of technologies that can be used to create in-house “enterprise YouTubes.” Vendors include Accordent and Qumu, and are not to be confused with online video platforms (discussed below).

HD room-based videoconferencing: An cheaper, HD-based alternative to telepresence systems. Vendors include Hewlett-Packard and Logitech.

Growth

Digital asset management (DAM): Products for organizing and managing digital content, such as OpenText’s Media Management.

Global content delivery networks (CDNs): Services such as those from Akamai and Limelight that accelerate the deliver of video and other content.

Online video platforms (OVPs): Hosted “enterprise YouTubes. Examples include 23 Video, Brightcove and Ooyala.

Telepresence: Forrester calls this the “corporate jet of videoconferencing.” Cisco’s the biggest name here.

Webcasting: Live or on-demand streaming of presentations. Accordent Technologies, Onstream Media and Sonic Foundry are some of the key vendors.

Obstacles Video Faces

The “Information Workers Are Not Quite Ready For Desktop Videoconferencing” report cites the following challenges for video in the enterprise:

The ability of the network infrastructure to handle video

The compatibility of video with the business’s culture

The willingness of management to push the use of the tools

The applicability of use cases to the business

Forrester’s Recommendation

Forrester recommends organizations find workers that are interested in video and run pilot programs with those workers and document the success (or failure) of these pilot programs. It also suggests preparing network infrastructure for video’s impact. Small pilot programs may not put too much strain on the network, and if successful could convince workers and management of a need for widespread use. Projects can be scaled out as the network infrastructure improves. On the other hand, if the pilots fail then enterprise will be saved from spending huge amounts of money on new hardware and software.