Because today’s startup generally requires significantly less seed capital to function, the legal contracts once required for large-scale deals are no longer appropriate. Rather than forcing startups to draft lengthy legal documents, one attorney is offering an invaluable resource to entrepreneurs. Best known as the Fenwick and West attorney responsible for Twitter, Ted Wang recently released a series of templates to help startup companies navigate the difficult task of investment financing.

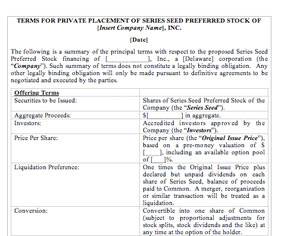

The Series Seed documents are a set of guideline documents that allow startups raising less than $1.5 million dollars to lighten the burden of the legal process. Documents include a certificate of incorporation, a preferred stock purchase agreement, an investors’ rights agreement and a seed term sheet.

Says Wang, “From an investor’s perspective, while moving away from the traditional full-blown financing documents entails giving up a number of rights and protections, when taken across numerous transactions, the benefits of spending less time and money on the documents outweigh the cost of sacrificing these additional rights and protections. Moreover, I don’t believe there’s anything included (or excluded) in these documents that will be wildly controversial.” Should there be any controversy, Wang plans on open sourcing the documents for discussion in the near future.

While entrepreneurs may use the documents at their own risk, some of the endorsers of the resource include Charles River Ventures, Ron Conway with SV Angel, First Round Capital and Polaris Ventures.

To download all four documents entrepreneurs can visit seriesseed.com. For additional resources on how to actually get to this portion of the investment process, early-stage companies should consult Venture Hacks’ series entitled Term Sheet Hacks.