Natural gas markets are under increasing stress in Europe after the Russian invasion of Ukraine. For now, the American gas market is marginally affected. These tensions have raised Europe’s awareness on securing alternative sources of gas supply, even at a premium price. U.S. natural gas markets are well-positioned to benefit from these developments and natural gas stocks will particularly from this situation.

The U.S. natural gas backdrop has been sustained since the beginning of the year. Colder than normal temperatures this winter, weighed on domestic natural gas inventories, causing Henry Hub natural gas prices to rise 31.6% year-to-date to $4.6 per Metric Million British Thermal Unit (MMBtu).

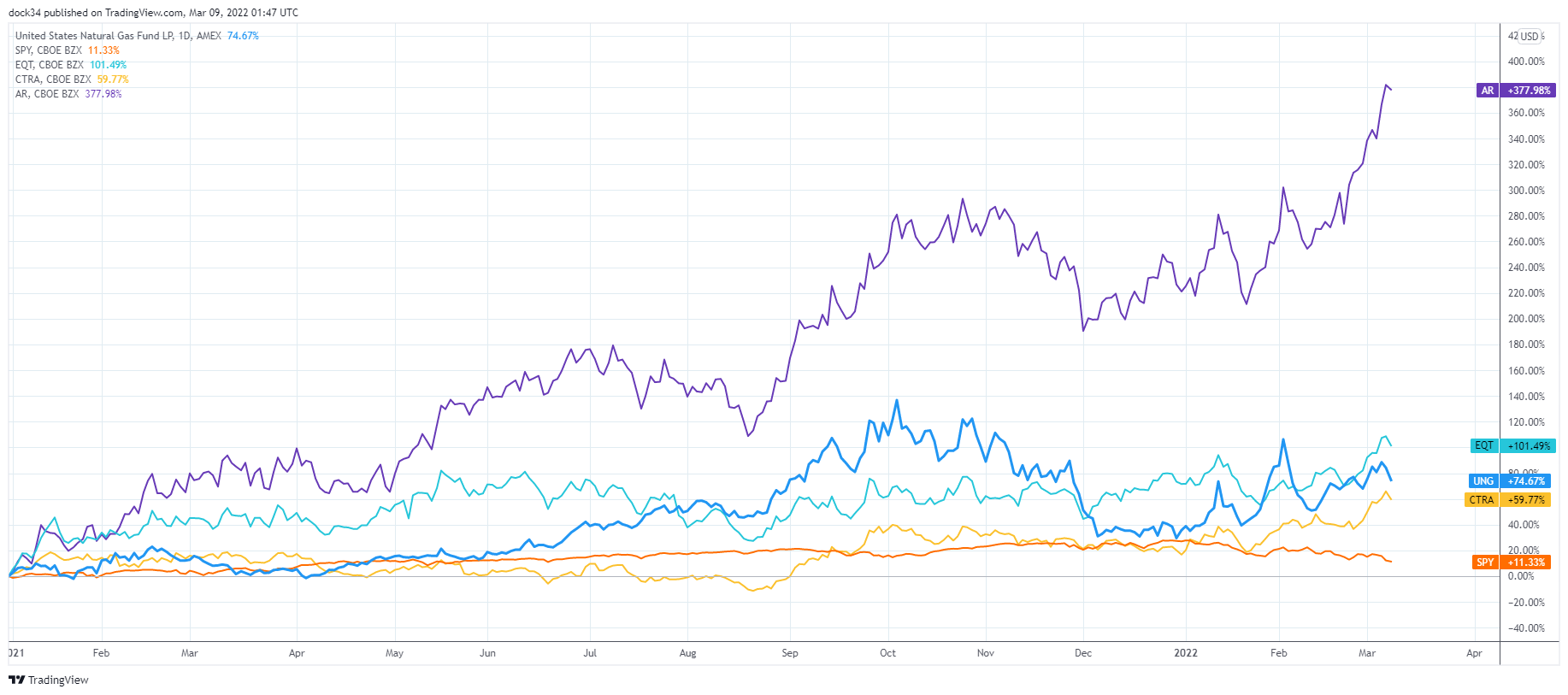

In the past year, natural gas stocks have outperformed the broader market. The United States Natural Gas Fund LP (NYSEARCA:UNG) surged 61.18% to $16.07 per share since March 2021. In the meantime, the SPDR S&P 500 Trust ETF (NYSEARCA:SPY) advanced only 7.51%% to $416.25 per share.

Click to Enlarge

In this context, let’s look into three natural gas stocks to buy to power up your portfolio.

Natural Gas Stocks to Buy: Coterra Energy (CTRA)

CTRA stock is a relatively new natural gas producer but it is a large-capitalization company. CTRA stock was formed last year after the merger of Cabot Oil & Gas and Cimarex Energy. CTRA displays one of the most vigorous top-line growth of the large natural gas pure-plays. Net sales are expected to surge 85.3% to $6.93 billion this year and net income is esteemed to advance robustly, up 73.1% to $2 billion.

With this impressive growth trajectory, CTRA stock is forecasted to maintain elevated net margins compared to industry peers. The consensus expects margins to reach 31.4% in 2022 and 29.4% in 2023. In the meantime, Coterra offers ample free cash flow, which is forecasted to nearly double this year, up 91.3% year-on-year to $2.56 billion.

In addition, Coterra Energy has one of the finest balance sheets of the natural gas complex. The leverage ratio of the company, measured by dividing debt with Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) stands at 0.95x at the end of 2021.

In terms of valuation, CTRA stock has one of the most stretched valuations of the peer group, but the ratios are still acceptable given the solid fundamentals of the company. The gas company trades at 2022 EV/EBITDA of 4.08x and P/E of 9.32x. Nonetheless, Coterra delivers an expected dividend yield of 3.64% in 2022, which should not leave shareholders indifferent.

Antero Resources (AR)

AR stock is a mid-cap natural gas producer that is set to benefit from the constructive natural gas backdrop. The company has strong financials and has subdued valuation metrics.

Antero Resources’ net sales advanced robustly in 2021, up 32.3% year-on-year to $4.61 billion. Top-line growth is forecasted to decelerate moderately in 2022, increasing by 21.2% to $5.6 billion. However, AR’s profitability remains comfortable. Net earnings are forecasted to jump steeply this year, reaching a level of $1.13 billion versus a net loss of $187 million in 2021.

With this fast advance, Antero’s net margin will bounce to 20.1%, a strong figure for a natural gas producer.

More interestingly, AR’s low debt is an asset for future growth prospects. With a net debt of $1.4 billion, representing a leverage ratio of 0.55x in 2022, the natural gas producer has sufficient financial power to develop its activity and finance new projects.

On the negative side, the company hedged 438 billion cubic feet (Bcf) of natural gas, as of Dec. 31, 2021, at a weighted average index price of $2.49 per MMBtu through 2023. This represents approximately 50% of Antero’s yearly production hedged at a significant discount compared to spot prices.

Despite that, Antero Resources trades at a small 2022 EV/EBITDA of 3.65x and P/E of 7.39x. The company even provides a tiny dividend yield of 0.43%. AR stock also announced a share repurchase program of up to $1 billion and plans to redeem remaining Senior Notes due 2025 on March 1, 2022, that are bullish catalysts for the stock.

Natural Gas Stocks to Buy: EQT (EQT)

EQT stock is a natural gas production company focused on the Marcellus and Utica Shales of the Appalachian Basin, with approximately 25 trillion cubic feet equivalents (Tcfe) of total proved natural gas and oil reserves.

The company’s fundamentals are expected to improve significantly this year. The profitability of the natural gas producer surged in the past year, following increasing natural gas throughput and lifting realized natural gas prices. EQT reported an adjusted net income of $1.8 billion for Q4, 2021, compared to only $64 million in Q4, 2020.

Going forward, the consensus of analysts expects EQT’s net sales to advance at a healthy pace in 2022, up 79% to $6.3 billion. Furthermore, EQT’s bottom line is forecasted to bounce robustly from a net loss of 1.15 billion in 2021 to a net gain of $821 million in 2022, representing a double-digit net margin of 15%.

EQT’s balance sheet is not as strong as AR. However, the natural gas producer is currently focusing on reducing debt. Net debt is esteemed to decline nearly 20% in 2022 to $4.31 billion, corresponding to a tolerable leverage ratio of only 1.42x versus 2.3x in 2021.

Besides, EQT hedged approximately 63% of 2022 gas production and less than 15% of 2023 production, which might limit gains this year, if natural gas prices continue to advance.

In terms of valuation, the natural gas company is exchanging at a low 2022 EV/EBITDA of 4.57x and at a tolerable P/E of 12.1x.

Cover Image Credit: Loïc Manegarium; Pexels; Thank you!

Published First on Investorplace: Here.