General Motors Co. said on Tuesday that it would stop advertising on Facebook because the platform didn’t generate enough sales. It is certainly not a great day for the social media giant, as it looks to float its initial public stock offering on Friday. Before you heed the naysayers, though, consider what Facebook is really good at.

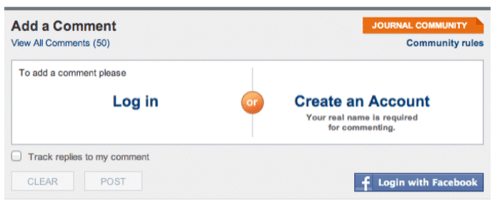

Need proof that Facebook will weather this and countless other storms? Look no further than the comments section of the very Wall Street Journal article that broke the news. The newspaper spurs logins by riding on Facebook’s coattails.

Facebook, in other words, is seemingly everywhere online. CEO and founder Mark Zuckerberg admits that his company is lagging behind archrival Google in advertising revenue, but the loss of one big advertiser is not enough to upend a company that could be worth more than $100 billion by this time next week. More importantly, the automaker is depriving Facebook of only $10 million in direct advertising buys; it will continue to spend about $30 million annually on Facebook content, agencies that manage that content and daily maintenance of its Facebook pages, according to The Wall Street Journal.

Jeff Dachis of Dachis Group, which uses data to help clients get the best return on their social networking campaigns, said Facebook’s power lies in engagement with brands, not generating sales through display advertising, meaning the GM decision isn’t a death knell for Facebook. Dachis said Facebook advertisers need to look at the platform as helping to build long-term brand loyalty.

“Although many will latch onto this news in the next few days as a reason for the skepticism around Facebook’s advertising model to continue, we believe that this proves that Facebook’s power lies in engagement, not display advertising. According to the WSJ report, GM is still spending approximately $30 million on Facebook. They’re not abandoning ship,” Dachis said. “Engaged users on Facebook – whether they’re on mobile or the browser – will monetize better than throwing mobile or display ads at them.”

GM signaled that it would continue to develop a strategy for using its brand page on Facebook. GM marketing chief Joel Ewanick told The Wall Street Journal that the company “is definitely reassessing our advertising on Facebook, although the content is effective and important.”

The newspaper reported that GM had begun reassessing its Facebook strategy earlier this year and made the decision to pull its advertising after several executives met with Facebook officials to address their concerns. We’ve asked Facebook for comment and will update when we hear back.

While the timing – just days before Facebook’s IPO – stings, people purchasing shares are theoretically looking to become owners of Facebook. Without discounting the people who will quickly try to flip their shares, other shareholders are looking at Facebook as a longer-term investment. They understand any business has good days and bad days.

There’s no denying that some advertisers are concerned about how effective Facebook advertising is. But, as we reported earlier this month (and, incidentally, in the wake of another Journal article questioning Facebook’s advertising strategy), a lot of advertisers are happy with the returns they’re seeing from Facebook.

In fact, GM’s decision may have more to do with the fact that Facebook just isn’t the right medium for an automaker.

“Although some large brands and agencies may be grumbling, not everyone is unhappy,” said Michael Nicholas, chief strategy officer at Roundarch Isobar, a digital marketing and advertising consultancy. “Brands whose business is more performance-oriented and predominantly e-commerce-based are seeing quality results and good service from third-party companies. Thinking about it from an ad spend point of view, it’s this ‘vocal majority’ that’s fueling all the headlines about ‘large brands and agencies question Facebook’s ad model.’”