Leverage allows traders to buy or sell large amounts of crypto with borrowed funds. For instance, trading $100 with 50x leverage would amplify the position to $5,000.

This guide explains everything you need to know about crypto leverage trading, including best practices and risk management. We also reveal the best exchanges with the highest leverage multipliers and the lowest fees.

The Top Crypto Leverage Trading Platforms

The following crypto leverage trading platforms offer the overall best experience:

- OKX – The Overall Best Place to Trade Crypto With Leverage in 2024

- Margex – Top Leverage Trading Platform Without KYC Requirements

- MEXC – Trade Hundreds of Derivative Markets With up to 200x Leverage

- Binance – Passively Trade Leveraged Futures via Automated Crypto Bots

- Bybit – Over 400 Perpetual Markets With Low Fees and Demo Trading Tools

- BingX – Secure Leverage Exchange With Anonymous Trading Accounts

- PrimeXBT – High Leverage Crypto Exchange With a 0.5% Margin Requirement

- KuCoin – A Great Option for Trading Leveraged Tokens Without Liquidation Risks

- Pionex – User-Friendly Exchange With Demo Trading and Automated Bots

- KCEX – Commission-Free Leverage Trading When Placing Limit Orders

The Best Crypto Leverage Trading Platforms Reviewed

Read on to choose the right Bitcoin leverage trading platform. The top providers are reviewed for fees, available markets, leverage limits, and other important variables.

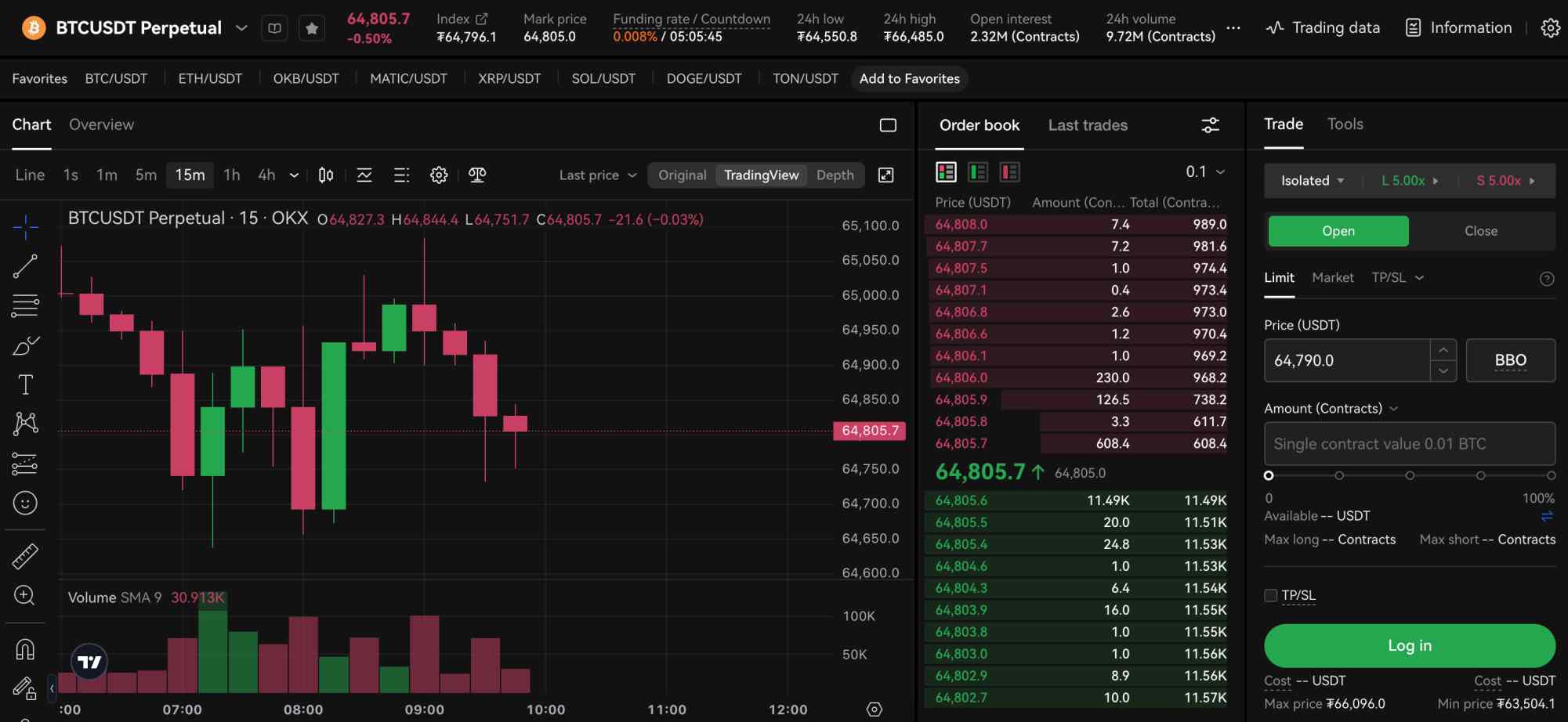

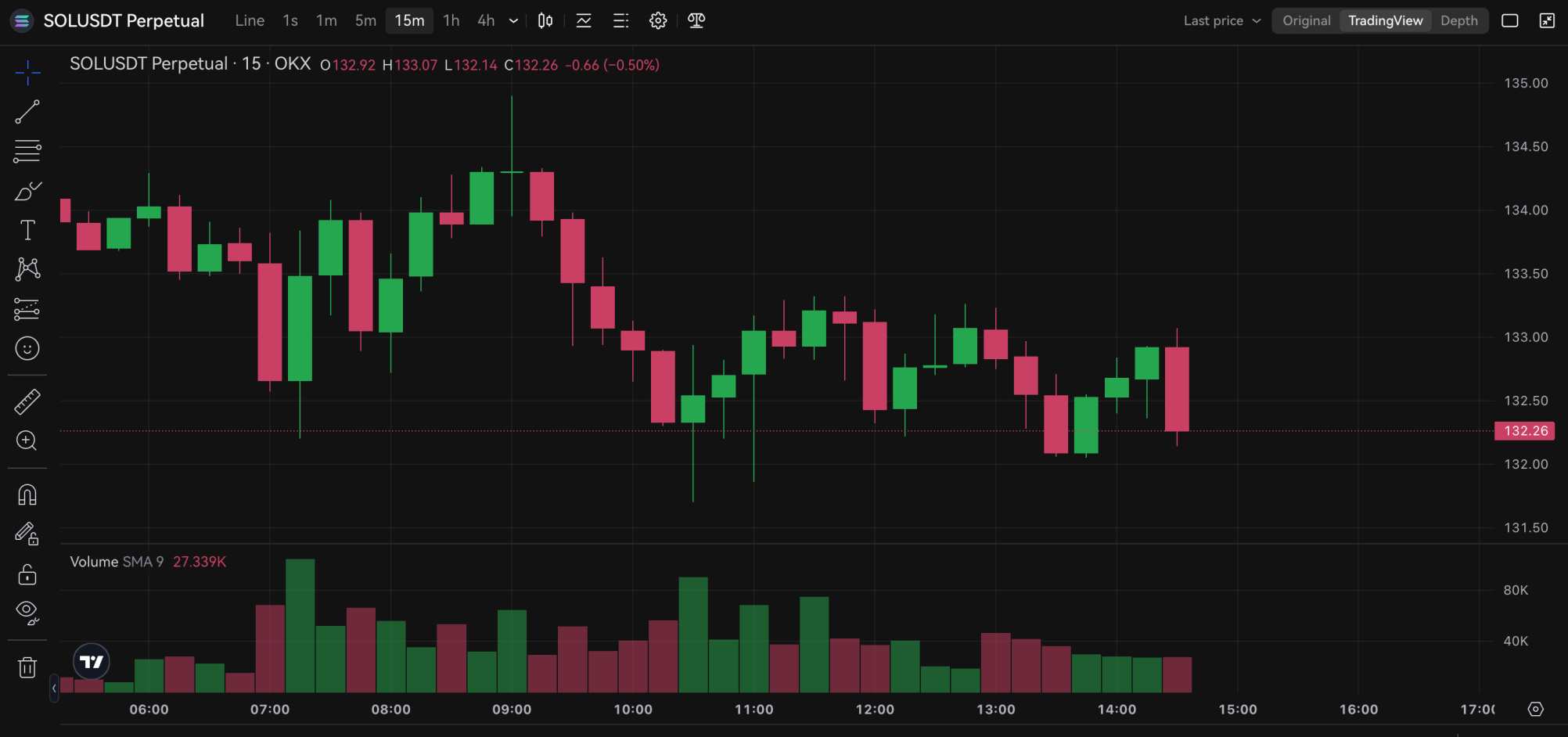

1. OKX – The Overall Best Place to Trade Crypto With Leverage in 2024

- Max Leverage: 100x

OKX is our overall top pick for trading crypto with leverage. The maximum leverage limit is 100x, so that’s $10,000 in trading capital for every $100 deposited. Leverage markets are offered via crypto derivative products. The most popular is perpetual futures, which covers more than 100 crypto markets.

This includes some of the best meme coins, such as cat in a dogs world, Shiba Inu, dogwifhat, and Dogecoin. Other popular markets include Bitcoin, Solana, BNB, and Cardano. OKX perpetuals can be settled in USDT, USDC, or the underlying crypto. Alternatively, traders can also access leverage via options.

However, just two options markets are available: BTC/USD and ETH/USD. Fees are competitive at OKX; futures trading commissions cost just 0.5% per slide. Options commissions are 0.03%. Discounts are available when placing limit orders or trading larger amounts. Additional features include advanced charting tools and high staking yields.

Pros

- The overall best place for crypto leverage trading

- Markets include perpetual futures and options

- Maximum leverage limit of 100x

- Trading commissions are competitive

- Easily deposit funds with a debit/credit card

Cons

- The options department supports just two coins

- Restricted nations include the US

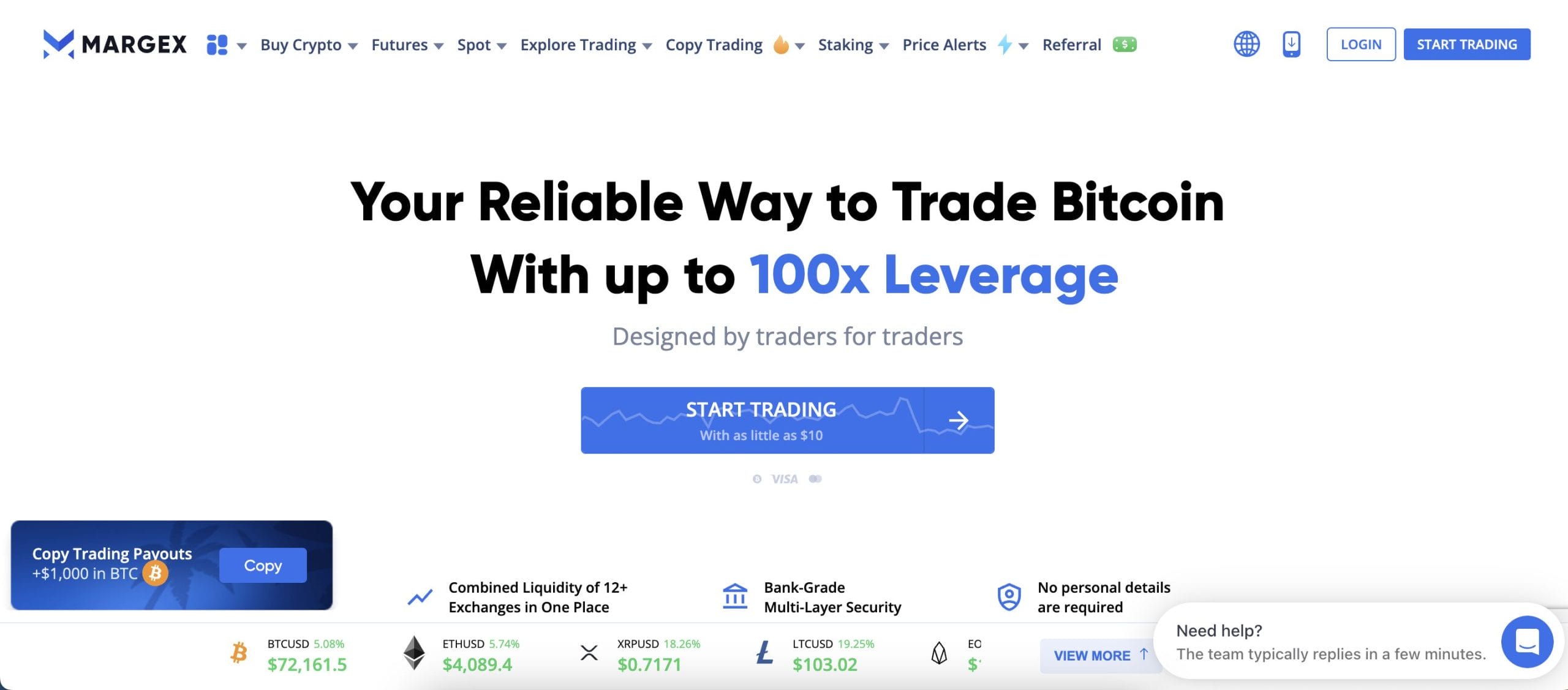

2. Margex – Top 100x Crypto Leverage Platform Without KYC Requirements

- Max Leverage: 100x

Margex is one of the best no-KYC crypto exchanges. Accounts take under a minute to open – just provide an email address and choose a password. Margex – which is used by over 500,000 traders, supports dozens of perpetual futures. This includes everything from Bitcoin, Dogecoin, and Litecoin to XRP, Ethereum, and Solana.

The maximum leverage limit is 100x. However, some perpetual markets come with lower limits of between 20x and 50x. Margex offers industry-leading fees. Limit and market orders attract a commission of 0.019% and 0.06%, respectively. Leverage funding fees – which are charged every 8 hours, vary depending on the coin.

Margex also offers copy trading tools. Beginners can replicate the positions of an experienced trader, at their preferred investment size. Margex is available on desktop browsers and smartphones. The latter includes an app for iOS and Android. note that Margex is an unregulated platform and US clients are not accepted.

Pros

- The best option for leverage trading without KYC requirements

- Open an account with an email address only

- Offers leverage limits of up to 100x

- Commissions start from just 0.019%

- Offers a mobile trading app for iOS and Android

Cons

- Operates without regulation

- Doesn’t offer options or delivery futures

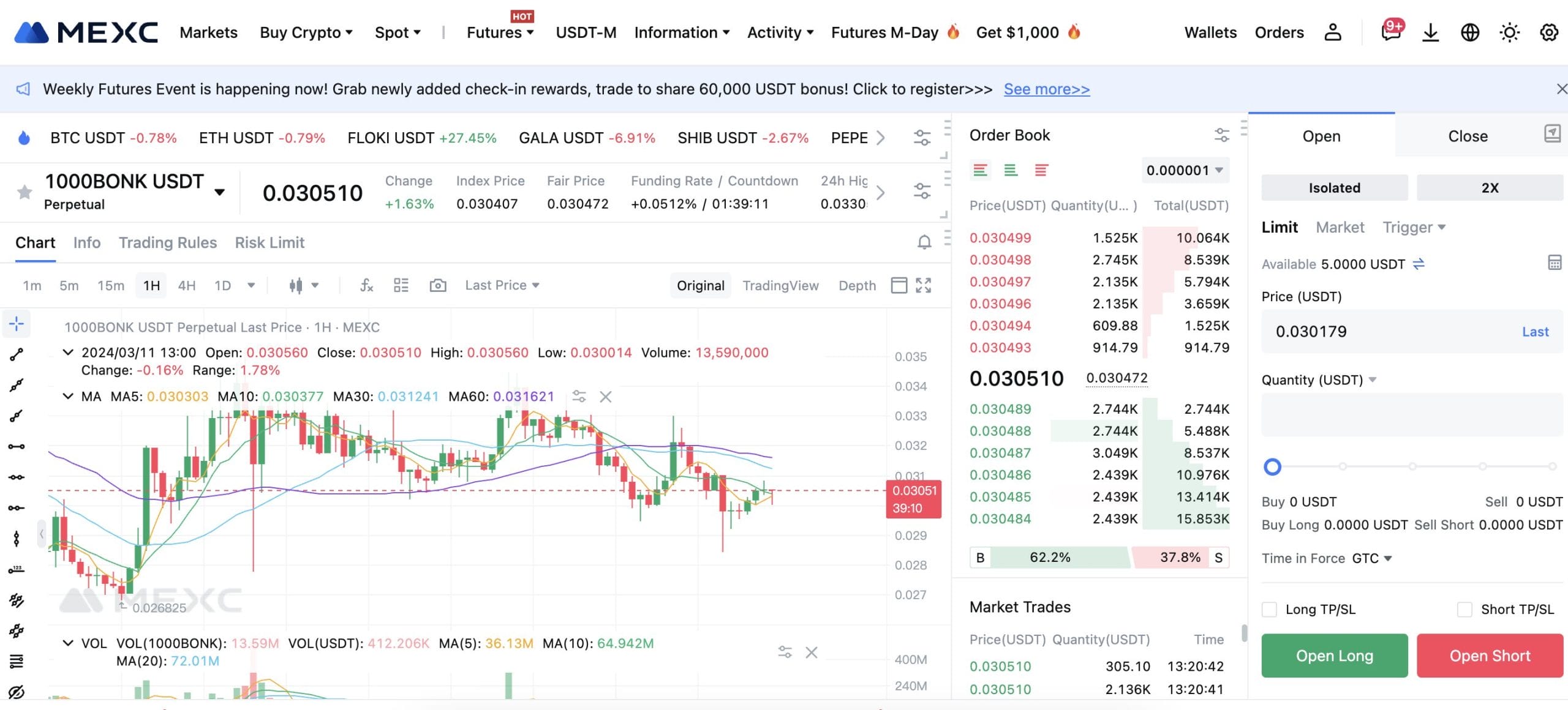

3. MEXC – Trade Hundreds of Derivative Markets With up to 200x Leverage

- Max Leverage: 200x

MEXC is a top-rated crypto exchange with a wide range of markets. These include hundreds of derivative products with leverage of up to 200x, which transforms a $100 balance into a $20,000 trading position. Some of the best cryptocurrencies to buy are listed, including Bitcoin, Cardano, Shiba Inu, Litecoin, Bitcoin Cash, and Solana.

Perpetual futures are the most popular trading product, with contracts settled in USDT. That said, high-risk traders can opt for futures that are settled in the underlying crypto. Either way, MEXC offers commission-free trading when placing limit orders. Market orders attract a small commission of 0.01%.

Another benefit of MEXC is that accounts come without KYC (limits apply). What’s more, withdrawal requests are often processed instantly. MEXC offers comprehensive charting tools with technical indicators. Traders can access MEXC online or via the iOS/Android app. MEXC also offers spot trading, staking rewards, and a P2P exchange.

Pros

- Offers maximum leverage limits of 200x

- Hundreds of derivative markets are listed

- Perpetuals are settled in USDT or the underlying crypto

- No futures commissions when placing limit orders

- Extensive charting tools with technical indicators

Cons

- Doesn’t offer crypto options

- Withdrawal charges are sometimes higher than the network fee

4. Binance – Passively Trade Leveraged Futures via Automated Crypto Bots

- Max Leverage: 100x

The next crypto leverage platform to consider is Binance – which is the largest exchange by trading volume and registered users. Binance supports multiple derivative products – including hundreds of perpetual futures. This includes meme coins like Bonk, Pepe, Myro, Shiba Inu, dogwifhat, and FLOKI.

Binance also supports options markets, including Dogecoin and XRP. One of the stand-out features is that leveraged products can be traded via automated bots. Over 114,000 pre-built bots are available, created by existing Binance users. Strategies include arbitrage trading, rebalancing, and short-selling.

Each bot specifies the leverage amount, the historical return on investment, and the runtime. No fees are charged when using bots, but traders must cover standard commissions. This starts at 0.02% and 0.3% when trading futures and options, respectively. Binance also offers one of the best P2P crypto exchanges, making it seamless to deposit funds.

Pros

- Trade leveraged markets via automated bots

- Over 114,000 pre-built strategies to choose from

- Bots are free to use – just cover standard commissions

- Hundreds of futures and options markets available

- Offers premium liquidity 24/7

Cons

- No longer offers accounts without KYC

- Leveraged markets are blocked in some countries

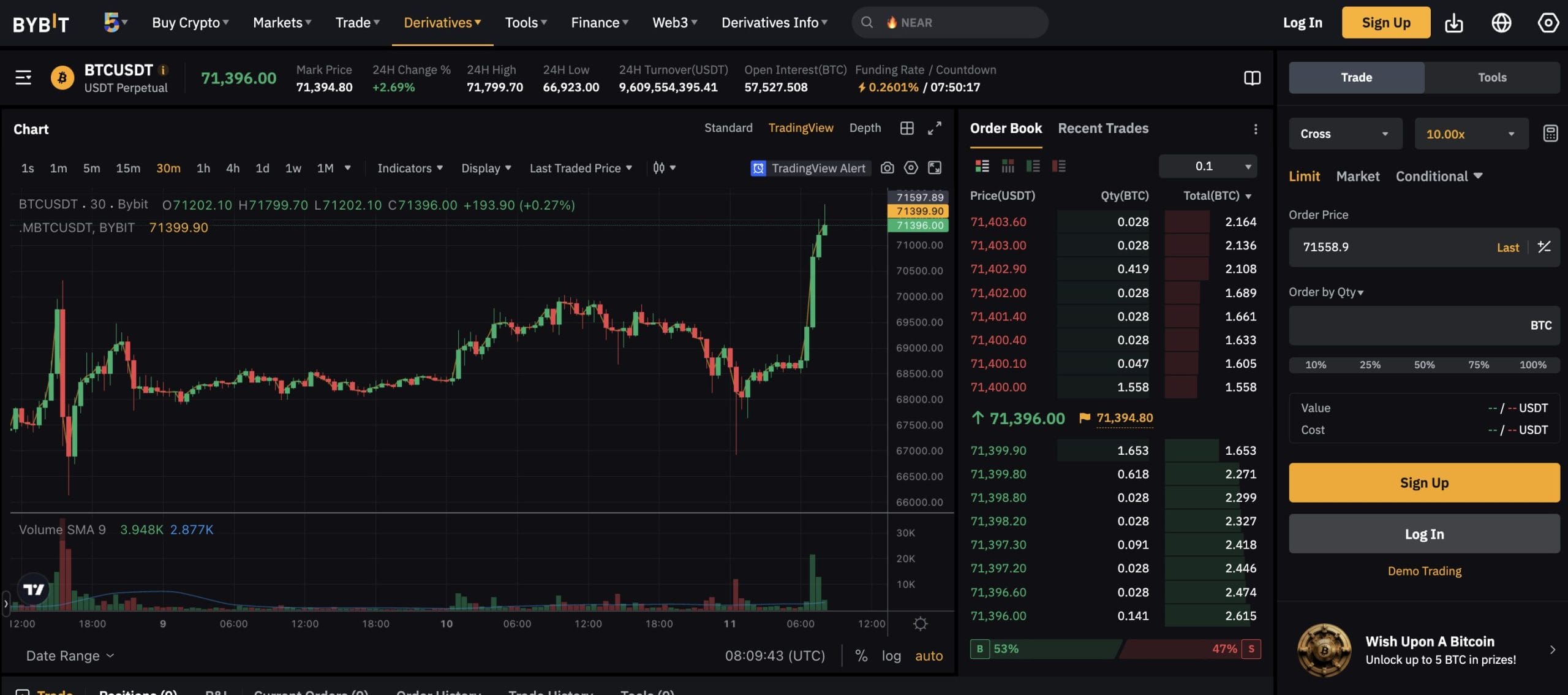

5. Bybit – Over 400 Perpetual Markets With Low Fees and Demo Trading Tools

- Max Leverage: 125x

Bybit is one of the largest derivative trading platforms globally. Almost 34 million active traders use Bybit, resulting in deep order books and premium liquidity. Bybit lists more than 400 perpetual futures markets, including new cryptocurrencies with small valuations. This will appeal to high-risk high-reward traders who seek enhanced volatility.

Depending on the market, Bybit offers leverage of up to 125x. In addition to perpetuals, Bybit also offers options markets and delivery futures. What’s more, contracts can be settled inversely, or via USDT/USDC. Another feature is Bybit’s demo trading facility, which mirrors live market prices.

This is a solid way to learn the ins and outs of crypto leverage trading. The demo platform offers charting tools and technical indicators, so you’ll get a real trading experience without risking money. Bybit charges derivative trading commissions of 0.02% per slide. This is reduced to 0.055% when placing limit orders on perpetual futures.

Pros

- Supports over 400 perpetual markets

- Also offers options and delivery futures

- Maximum leverage limit of 125x

- Market takers pay just 0.02% per slide

- Offers a risk-free demo trading facility

Cons

- Traders in some countries are banned – including the US

- Lack of regulation will be a concern for some traders

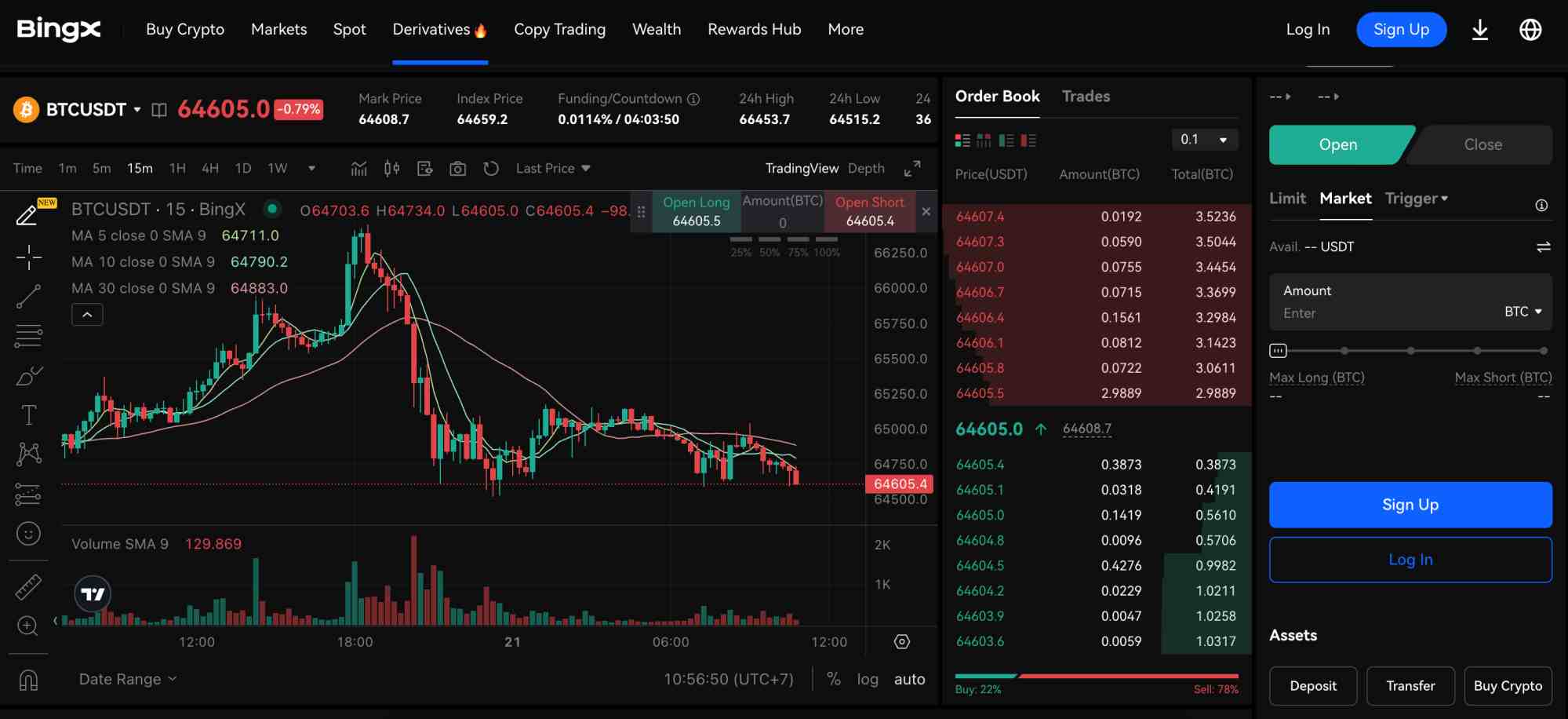

6. BingX – Secure Leverage Exchange With Anonymous Trading Accounts

- Max Leverage: 125x

BingX is another popular leverage platform that offers a private trading experience. Not only does BingX allow anonymous accounts but the daily withdrawal limit is $50,000. This means you can trade large amounts without uploading ID verification documents. Moreover, BingX offers a maximum leverage limit of 125x.

Perpetual and standard futures are supported, with hundreds of crypto markets to choose from. Traders can find a suitable market by the trading category, such as layer-1 coins, meme coins, or RWA tokens. Contracts can be settled in the underlying crypto or USDT. Commissions are just 0.05% when trading perpetuals.

Standard futures are slightly cheaper at 0.045% per slide. BingX is also a great option for technical traders. Its advanced charting screen covers multiple time frames, indicators, and drawing tools. BingX has also integrated its charts with TradingView. BingX is considered a safe exchange; it offers 100% proof of reserves.

Pros

- Trade standard and perpetual futures with 125x leverage

- Advanced charting tools with TradingView integration

- Low trading commissions and leverage funding fees

- Provides verifiable proof of reserves

- Also also offers copy-trading tools

Cons

- P2P payments only support USDT

- Doesn’t hold any tier-one licenses

7. PrimeXBT – High Leverage Crypto Exchange With a 0.5% Margin Requirement

- Max Leverage: 200x

PrimeXBT offers perpetual futures at competitive commissions. Market orders are charged 0.02% per slide. Place a limit order to reduce the commission to just 0.01%. Leverage financing fees average 0.01%, charged every 8 hours. 31 futures markets are available, including Bitcoin, Cardano, Avalanche, Uniswap, and Dogecoin.

The maximum leverage limit is 200x, so there’s a $10 margin requirement for every $2,000 traded. PrimeXBT also supports other trading markets, including commodities like gold and oil, forex, and indices. Non-crypto products are traded as contracts-for-differences, meaning leverage is also available.

The PrimeXBT trading platform – packed with analysis tools, is available on multiple devices. This includes desktop browsers and an app for iOS and Android. Customer service is highly rated; and available 24/7 via live chat. PrimeXBT supports fiat payment deposits, including Visa and MasterCard.

Pros

- Trade futures contracts from 0.01% per slide

- Competitive financing fees are charged every 8 hours

- Offers leverage of up to 200x

- Also supports forex, indices, and commodities

- Accepts Visa and MasterCard payments

Cons

- Supports just 31 futures markets

- US clients aren’t accepted

8. KuCoin – A Great Option for Trading Leveraged Tokens Without Liquidation Risks

- Max Leverage: 100x

Like many crypto leverage trading platforms, KuCoin offers a comprehensive selection of perpetual futures. Over 300 futures contracts are listed, including Ethereum, Pepe, FLOKI, Solana, and Dogecoin. Contract settlement options include USDC, USDT, and the underlying crypto.

The maximum leverage limit on perpetual futures is 100x. That said, KuCoin also offers leveraged tokens. This instrument tracks real-time crypto prices with a fixed multiplier. For example, Bitcoin can be traded as 3x long or short. Suppose the Bitcoin spot price increases by 2%. Those trading 3x long will make 6% gains.

The best thing about leveraged tokens is that positions can’t be liquidated. That said, you’re capped at 3x leverage, which might not be enough for some traders. KuCoin offers many other features, including advanced charting tools, savings accounts, and crypto loans. It also offers one of the best decentralized crypto wallets.

Pros

- Supports over 300 perpetual futures markets

- Maximum leverage of 100x

- Also offers leveraged tokens without liquidation risks

- Used by over 30 million traders globally

- Robust security features including 2FA

Cons

- KYC is mandatory for all account holders

- Leveraged tokens are capped at 3x

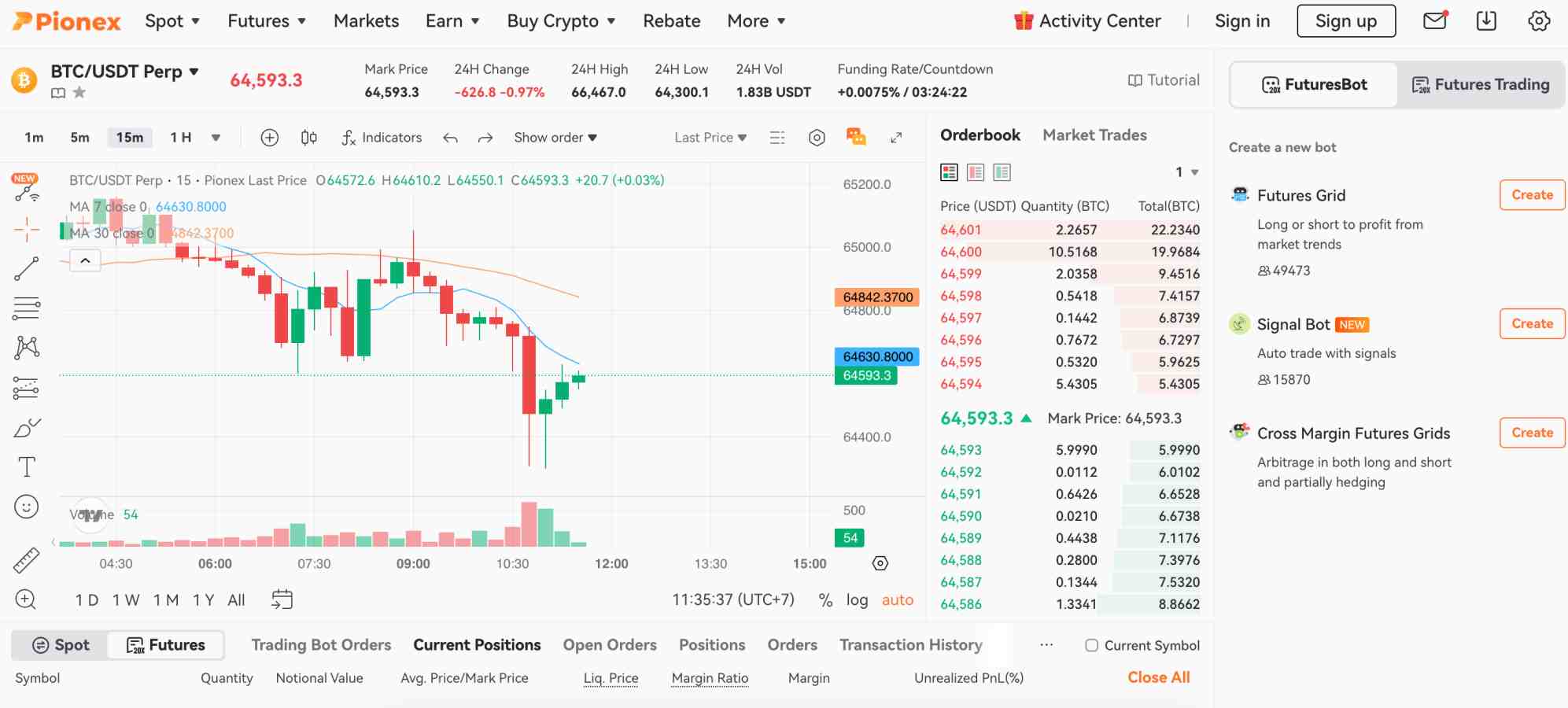

9. Pionex – User-Friendly Exchange With Demo Trading and Automated Bots

- Max Leverage: 100x

The next cryptocurrency leverage trading exchange to consider is Pionex. This is one of the best options for beginners. Not only is the Pionex trading dashboard user-friendly but it comes with demo facilities. This means newbies can try technical indicators and drawing tools without risking funds.

What’s more, Pionex offers passive investing tools via automated bots. 16 pre-built strategies are available, including arbitrage and futures trading. Pionex offers leverage of up to 100x when trading perpetuals. Almost 380 crypto markets are supported. This includes Toncoin, Dogecoin, Litecoin, Cardano, BNB, Pepe, and Bitcoin.

Pionex also offers competitive commissions. Market orders on futures trades cost just 0.05% per slide, and limit orders are charged 0.02%. Pionex is also a solid option for depositing fiat money. EUR and GBP bank transfers are fee-free. Debit/credit cards and e-wallets are also accepted, covering over 90 currencies.

Pros

- One of the best leverage platforms for beginners

- Trade futures with leverage of up to 100x

- Offers automated bots for passive trading

- Low futures commissions starting from 0.02%

- Accepts fee-free bank transfers in EUR and GBP

Cons

- Doesn’t offer leverage trading crypto in the USA

- Advanced traders might find the platform too basic

10. KCEX – Commission-Free Leverage Trading When Placing Limit Orders

- Max Leverage: 200x

Last on this list of Bitcoin leverage trading platforms is KCEX. Traders have access to more than 100 perpetual futures. Markets are split by the project category, such as GameFi, DeFi, and meme coins. The maximum leverage available is 200x, although smaller-cap tokens come with lower limits.

Best of all, KCEX offers commission-free trading when placing limit orders. Those placing market orders pay 0.02% slide. Accounts take seconds to open – no KYC is needed (limits apply). This is ideal for trading leverage markets anonymously. The KCEX trading dashboard is fully customizable and comes with TradingView integration.

Bespoke order types, in-depth order books, and dozens of technical indicators are available. KCEX can be accessed on browsers or the native mobile app. Customer support is available 24/7 via live chat. There’s also an extensive help center with trading guides. KCEX is also a good option for spot trading.

Pros

- Trade commission-free when placing limit orders

- Maximum leverage of 200x

- No KYC verification when joining

- Supports a huge range of altcoin markets

- Top-notch support is available 24/7

Cons

- Doesn’t offer leveraged options markets

- Some nationalities aren’t supported

What Is Leverage in Crypto?

Leverage is a popular trading tool that amplifies position values. It enables traders to buy and sell cryptocurrencies with more than they have in their accounts. For example, suppose you trade $500 with 10x leverage. This increases the position size to $5,000 – even though you’re only risking $500. In this case, the initial $500 would represent your margin.

The trading platform supplies the excess funds, which incur interest payments known as funding fees. Leverage is a high-risk strategy, as liquidation will automatically close the position. This means the trading platform keeps the initial margin. The liquidation risk increases as more leverage is taken, so beginners should tread carefully.

How Does Leverage Trading Crypto Work?

Leverage is essentially a loan between the trader and the exchange. The initial margin is the amount put up front by the trader. This is amplified depending on how much leverage is taken.

- For example, let’s say you risk $1,000 at leverage of 25x.

- This increases the trade value from $1,000 to $25,000 – meaning you’ve borrowed $24,000.

- That $24,000 will incur funding fees – usually charged every 8 hours.

Now, this example shows that the margin requirement was 4%. This is because you entered a $25,000 trade but only risked $1,000. So, if the trade value declines by 4% – it will be liquidated. The result? The position is closed automatically and you lose that $1,000 margin.

Nonetheless, crypto leverage trading remains popular with high-risk traders. After all, significant gains can be made without needing a lot of upfront capital.

- For instance, let’s say you risk $500 in margin with 100x leverage.

- You’re long on BTC/USD.

- The total position size is $50,000.

- BTC/USD hits a key support level and increases by 5%.

- You would have made just $20 on a $500 position without leverage.

- However, 100x leverage was used, which increased the profit to $2,000.

Benefits of Crypto Leverage Trading

Crypto leverage trading is ideal for several use cases.

First, traders with limited capital can trade with much larger amounts. For instance, suppose you’ve only got $100 to trade with. Making viable profits will be challenging, considering the amount being risked. However, by using a platform with 200x leverage – you’ve turned a $100 balance into $20,000 worth of tradable funds.

Leverage is also ideal for traders implementing short-term strategies. For example, scalpers often keep positions open for several minutes or seconds. This means the profit potential is minimal. However, small margins can be amplified into sizable gains when applying leverage.

Another use case for leverage is short-selling. This is because leveraged products – such as perpetual and delivery futures, allow traders to go long or short. This can be handy if you believe a market downfall is coming. It can also help you hedge existing positions without cashing out.

Leverage can also help traders become more efficient with their capital. For example, you might want to build a diversified portfolio but you’ve got limited funds. Using leverage increases the available bankroll, so you can easily distribute the excess funds to multiple coins and tokens.

Things to Consider Before Trading Crypto With Leverage

Leverage is a high-risk strategy, so some best practices should be considered. First, beginners should avoid trading with too much leverage. The likelihood of liquidation is higher as the leverage multiple increases. For instance, trading with 100x leverage converts to a 1% margin requirement. Liquidation will happen if the trade declines by 1%.

However, trading with 5x leverage increases the margin requirement to 20%. This offers considerably more breathing space, and vastly reduces the odds of liquidation. Another best practice is to be aware of fees. Just like standard trading markets, commissions are charged per slide.

- However, commissions not only include the margin requirement but also the borrowed funds.

- For example, suppose you risk $2,000 at 20x leverage.

- Your total trade value is $40,000, which is multiplied by the commission percentage.

Funding fees will also be charged on the borrowed funds. That’s $38,000 ($40,000 – $2,000) in this example. As such, the margin balance will diminish each time the next funding round begins. This is usually every 8 hours, meaning charges take place three times per day.

Beginners should also ensure stop-loss orders are placed on each position. Should the trade decline by the stated stop-loss point (e.g. 2%), it will be closed automatically. This will help you avoid liquidation.

It’s often best to start with a demo account when crypto trading with leverage as a beginner. This enables you to practice placing orders, analyze price movements, and assess profitability over extended periods. You’ll also become proficient in margin requirements, funding fees, and liquidation risks.

How to Pick a Bitcoin Leverage Trading Platform

Research is a must when choosing a Bitcoin leverage trading platform. Avoid focusing purely on maximum leverage limits. Equally as important are fees, security, and available markets.

Consider the factors below when selecting a provider.

Security

Safety and security should be the initial focus when shortlisting platforms. Do note that most crypto leverage exchanges are unregulated. They’re often based in offshore locations like the Seychelles, where regulatory demands are weaker.

Even so, traders should ensure their chosen platform offers robust security features. For instance, the exchange should hold client balances in cold storage. Accounts should be protected by 2FA and email confirmations, or biometrics when using a smartphone app.

Verifiable and audited proof of reserves is also important. This ensures at least 100% of client funds are held by the exchange.

Leverage Amount

Trading platforms specify maximum leverage limits, which average 100x. However, some platforms offer even higher amounts. For example, MEXC, PrimeXBT, and KCEX offer 200x.

It’s worth checking the leverage limits for the coins you wish to trade. For example, you might get 200x when trading Bitcoin and BNB. But meme coins like dogwifhat and Bonk might only offer 50x.

Tradable Cryptos

It’s also wise to check which crypto assets are supported. The number of markets can vary widely. For example, PrimeXBT lists just 31 futures markets, while Bybit lists more than 400. Most leverage crypto trading platforms offer perpetual futures.

However, some traders might prefer other financial instruments. For example, OKX also offers options chains for Bitcoin and Ethereum. Alternatively, Bybit is ideal for trading delivery futures, which come with multiple settlement dates and strike prices.

Another instrument is leveraged tokens on KuCoin. Although leverage is capped at 3x, positions can’t be liquidated. This is a great option for beginners.

Fees

Fees are another important variable to explore. First, assess the commission rate for the markets you want to trade. For example, Binance charges just 0.02% when trading futures. However, options commissions are higher at 0.3%.

Remember that fees can vary depending on the order type. For instance, limit orders cost just 0.019% per slide at Margex. However, market orders are more expensive at 0.06%.

Funding fees should also be considered – not only the interest rate for the respective market but how frequently they’re charged.

Tools & Features

The best crypto leverage trading platforms offer tools and features, such as:

- Demo Accounts: Margex is a top option for demo accounts. No registration is needed – meaning you can trade risk-free within seconds. The demo account offers the same experience as the real-money platform.

- Copy Trading: Check out the copy trading tool on BingX. You can copy an experienced trader, so anything they buy or sell is replicated. This tool is ideal for beginners.

- Charting Tools: Experienced traders rely on advanced charting tools to make informed trading decisions. Charts should offer real-time pricing, deep order books, and technical indicators.

- Bot Trading: Automated bots are another passive trading option. Binance and Pionex are great options, and traders have multiple pre-built strategies to choose from.

User Experience

Mistakes can be costly when trading with leverage. Especially when applying high-leverage multipliers. Therefore, traders should ensure the user experience is suitable before placing orders. Demo accounts are the best way to assess suitability. No deposit is needed, so you can test the platform completely risk-free.

Evaluate how easy or difficult it is to find a trading market, and how transparent the platform is on leverage fees and funding rates. The user experience also extends to placing orders, deploying charting tools, and reviewing historical performance metrics. Those planning to trade on a mobile device should test the respective app.

How to Start Trading Crypto With Leverage

Beginners can follow the steps below to get started with OKX – our top pick for crypto leverage trading in 2024:

- Step 1: Open an OKX Account – Visit the OKX website and open an account. Provide an email address and a strong password.

- Step 2: Complete KYC – Users must complete the KYC procedure before depositing funds. This requires a government-issued ID and some basic personal details.

- Step 3: Deposit Funds – Verified OKX accounts can deposit funds with fiat money – including debit/credit cards and bank transfers. Alternatively, deposits can be made with any supported crypto.

- Step 4: Choose a Leverage Market – Choose between perpetual futures and options. Then select the coin you want to trade with leverage.

- Step 5: Place an Order – Set up a buy (long) or sell (short) order, depending on the required market direction. Type in the initial margin and the leverage multiple. State the stop-loss order price for risk management. Check everything is correct and confirm the order.

Legality of Crypto Leverage Trading

Crypto leverage trading is legal in most countries. However, there are some exceptions.

- For example, most platforms prohibit US clients from joining. This is because leverage providers must be approved and licensed by relevant US bodies. This includes the Commodity Futures Trading Commission (CFTC) when trading leveraged futures. In contrast, crypto leverage exchanges are typically unregulated and based offshore, which doesn’t conform with US regulatory requirements.

- Another exception is retail clients from the UK. This covers any UK resident who sits outside of the professional-client landscape. As per the Financial Conduct Authority (FCA), leveraged crypto derivatives have been banned since 2021. This includes perpetual and delivery futures, options, and contracts-for-differences.

- Similar to the UK, Canadian clients are also prohibited from crypto leverage trading. The Canadian Securities Administrators (CSA), among other regulatory guidelines, made the ruling in late 2022.

- While Australian retail clients can legally trade crypto with leverage – limits apply. As per the Australian Securities and Investments Commission (ASIC), crypto leverage is capped at 2x.

Ultimately, regulations and limits will vary depending on the jurisdiction. Before proceeding, spend some time exploring the rules in your home country.

Conclusion

Leverage can be a useful tool when used wisely – especially when trading crypto with a small capital balance. However, risk management is crucial.

Traders should understand the risks of liquidation and the rules on margin calls and funding fees. To avoid excessive losses, stop-loss orders should always be deployed.

FAQs

Is crypto leverage trading allowed in the US?

US clients can only access crypto leverage facilities with regulated and approved platforms, such as those authorized by the CFTC.

What is 100x leverage in crypto?

100x leverage multiplies the initial margin by 100. For instance, a $50 margin at 100x would amplify the position to $5,000.

What are the best crypto leverage trading platforms?

OKX, Margex, and MEXC are the best crypto leverage trading platforms for safety, low fees, and supported markets.

Which crypto exchanges offer 1000x leverage?

1000x leverage with crypto is available at CoinUnited and DTX Exchange.

Is trading crypto with leverage more risky?

Yes, crypto leverage positions can be liquidated if they decline by a certain percentage – meaning you’ll lose the initial margin.

Is leverage trading worth it?

Leverage can be worth it when best practices are followed, such as deploying stop-loss orders and adhering to a sensible bankroll management strategy.

References

- What is financial leverage? (Corporate Finance Institute)

- CFTC registration database (CFTC)

- FCA bans the sale of crypto-derivatives to retail consumers (FCA)

- ASIC’s CFD product intervention order extended for five years (ASIC)

- CSA provides update to crypto trading platforms operating in Canada (CSA)