As an entrepreneur, it’s important to stay in-the-know about the venture capital industry and how new data compares to previous years. Thanks to some recently released numbers from the National Venture Capital Association (NVCA), we can clearly see some continuing trends in the industry that could affect startups and their ability to raise capital. As the first half of 2010 comes to a close, funds raised by VC firms trended downward while IPOs, mergers and acquisitions continued to build momentum.

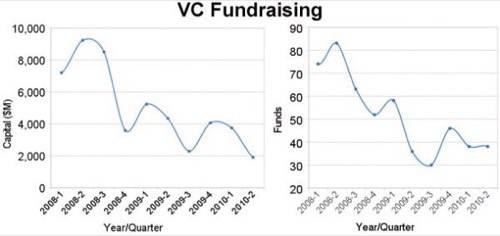

In order to provide startups with funding, venture firms must themselves raise money, and over the last few years, these funds have become smaller and smaller. In the second quarter of this year, this trend continued as firms raised just under $2 billion – a near 50% quarterly decline, and almost one-fifth of the amount raised 2 years ago.

The amount of firms raising money remained constant from the previous quarter, meaning the deals were much smaller in size this quarter. 38 firms raised capital in each quarter this year – a figure that is far off pace to match yearly totals from previous years.

Between 2005 and 2008, the industry averaged over 240 VC fundraising deals a year. In 2009 this number fell to 140, and 2010 is looking to have similar results. With fewer firms raising smaller amounts of cash, the market for startups seeking funding is smaller and more difficult to penetrate.

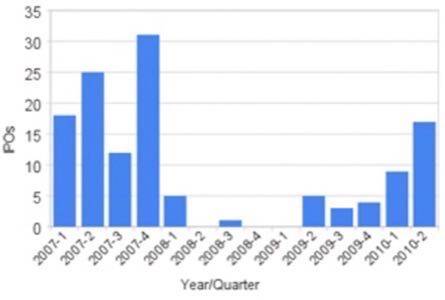

For current venture-backed companies, however, exits via mergers, acquisitions or public offerings are showing some of the best numbers in years. In the second quarter of this year, 17 companies went public, falling just shy of equalling the IPO total from all of 2008 and 2009, and the highest total since 2007. 9 of the companies came from the information technology category, and the largest offering was Tesla Motors, Inc. which began trading at the very end of the quarter.

Mergers and acquisitions dipped slightly from the first to second quarter in 2010, as was to be expected after the first quarter broke quarterly NVCA M&A records. 2010 is on pace to have more M&A deals than any other year, according to the NVCA, but the value of these deals is not measuring up to averages seen in previous years. For venture-backed startups, this means more deals are happening this year, but the payouts are slightly below average.