There are nearly 7 billion people in the world. In 2011, a smart device – be it a tablet, smartphone or a PC – was sold for one out of every seven of those people, according to estimates from International Data Corp. The research firm reports that about 946 million smart devices were shipped last year at a market valuation of $489 billion. Mobile is booming, with nearly 500 million of those devices being of the smartphone variety. The world is becoming connected, and growth does not project to slow any time soon.

By 2016, IDC predicts that 1.84 billion units will be shipped, and about a billion of those will be smartphones. That is a compound annual growth rate of 15.4%. While we often say, “company X is late to the game,” the projected growth in smart devices means that there will be significant room for market share to be spread around among intelligent companies that know how to make a dent.

Does that mean there is hope for Windows Phone?

Taking Stock of the Landscape

Android held 29.4% of the market for devices running ARM CPUs in 2011 and is expected to grow to 31.1% in 2016. Apple’s iOS devices held 14.6% of the market and is expected to grow to 17.3% in 2016.

Android’s worldwide channel strategy is what gives it a leg up over iOS and Windows Phone. Android competes directly with lower-end “smart” devices from the likes of Nokia (Symbian), Samsung (Bada), BREW-based feature phones with connection to the Internet, and lower-end BlackBerries. And Android is winning the race because, on a feature level, it is a better product than any of those alternatives. Samsung knows this well. As the leading Android purveyor, it has flooded the market across the world with a variety of Android devices at varying price points. Say what you want about the Samsung Galaxy II versus the iPhone 4S, Samsung is starting to own the lower-end of the smartphone market.

Chart: Worldwide Smart Connected Device Shipments, 2010-2016 (Unit Millions)

Description: This data comes from IDC’s WW Quarterly PC Tracker, WW Quarterly Mobile Phone Tracker, and WW Quarterly Media Tablet and eReader Tracker.

Tags: Tracker, mobile phones, tablets, forecast, PCs, devices, consumer, IDC …

Author:

Nokia will have something to say about that. As the leading cellphone-maker in the world for the last decade, the province of the lower-channel and emerging markets has belonged to the denizens of Espoo, Finland. It is targeting its Asha devices at young consumers in emerging markets and will spend a lot of money to ensure that those devices find their way into users’ pockets.

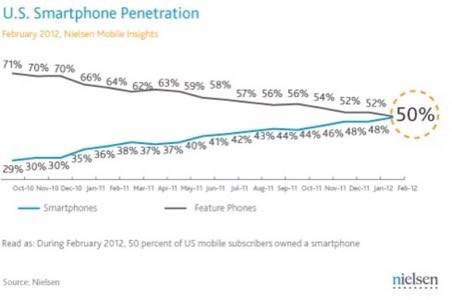

The question becomes, what drives the 15.4% growth over the next four years? The U.S. market is not far from saturation, and Europe is not far behind in smartphone adoption. Nearly two-thirds of all young consumers in the U.S. have a smartphone. Overall smartphone market penetration in the U.S. will likely eclipse 50% in Nielsen’s March Mobile Insights report. As of February, penetration is at 49.7%.

Windows Phone, Market Leaders and the World

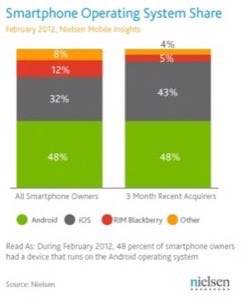

In the last three months, Android accounted for 48% of smartphone purchases in the U.S. Apple’s iOS wa second at 43%. That leaves 9% to be split among the remaining competitors, and Research In Motion’s BlackBerry took 5% of that.

There is not much room left in the U.S. market for competitors to make a dent. That does not mean that Nokia and Microsoft will not try to break down the door. The Nokia Lumia 900 is set to hit the market through AT&T on April 8th and will feature a multi-tier promotional blitz from the carrier, Nokia and Microsoft. In terms of up- and down-channel marketing, expect to see a lot of ads for the Lumia 900 wherever you go.

But will it make a difference? Nokia is targeting the U.S. market where news of its products have fallen on deaf ears since the beginning of the smartphone revolution. Michael Woodward, VP Mobile Device Portfolio at AT&T, told us yesterday that the Lumia 900 will be prominently featured in the front window of AT&T stores upon launch, and the staff will be trained to use the device. He also said that the “Smoked By Windows Phone” campaign would not be coming to AT&T stores but that sales representatives would be made aware of it.

We will have much more on the Lumia 900 next week. Stay tuned.

The fact of the matter is that right now, there is not a lot of room for horizontal movement within the U.S. for new manufacturers. Samsung dominates Android with HTC and Motorola picking up the slack, Apple has the iPhone and BlackBerry is a decaying brand. Can that change between now and 2016? Perhaps, but the first movers (Apple and Google) are cementing the advantage and closing the sales loop. While many pundits will point to the fact that Android has come out of the blue and captured an astounding amount of U.S. and world market share since 2009, it was built on a ubiquitous sales channel strategy, price and the access to apps, and, to a certain extent, the “cool factor.”

Any manufacturers looking to repeat the success that Android has had and dethrone it from the top spot will have to beat the platform on several different layers. Android’s rise has come at the expense of BlackBerry because it was touchscreen, had more apps, and better marketing and the backing of a hip tech giant. With billions of dollars now swirling around Android from a variety of sources, it is a very difficult incumbent to break.

Image: Nokia Lumia 800

With Windows Phone, Nokia should play up to one of its key strengths: Down-channel shipments and price. Like Android did in the U.S., Nokia has a chance to disrupt a market. The only difference is that the market Nokia will disrupt is its own, by phasing out Symbian and providing cheap but elegant Windows Phones.

Nokia and Microsoft cannot beat Android in the U.S. using the same blueprint that Android did. That opportunity has passed. The best it can hope for is to usurp RIM’s remaining marketshare and take a small sliver from Android.

But, as the IDC numbers show, that does not mean that Windows Phone is doomed. There will be about 7.615 billion smart devices sold between 2012-2016 and most of those will be smartphones. The ingredients are there for the platform to spread and still rake in billions of dollars in sales across the world.

The pie is getting bigger. That will give rise to opportunities for everybody.

Top image: Way Too Many Gadgets by Dan Rowinski