In previous months, we’ve covered here in ReadWriteWeb a new and emerging concept called crowdfunding – a way for entrepreneurs, especially apps developers, to obtain just enough funding to get off the ground, by way of a handful of collected funding sources contributing no more than $1,000 each. It’s a superb alternative for businesses as small as one person to build an app and place it in the cloud.

The problem is, it’s not officially legal. Not that there’s any enforcement against the practice at the moment; in fact, last week the House of Representatives overwhelmingly approved by a vote of 407 – 17 language that amends the Securities Exchange Act of 1934, in order to exempt crowdsourced funds from having to clear legal hurdles from every state from which a member contributes funding.

But a last-ditch effort to rile up some opposition to the Senate version of the bill, perhaps from Senate Democrats, is being put together by the North American Securities Administrators Association (NASAA). Their theory is this: Internet-based ventures are more speculative, and are thus more susceptible to carpetbagger-like shysters who could take advantage of entrepreneurs through spamming techniques.

Aren’t there plenty of banks?

In testimony before the Senate Banking Committee last Thursday, NASAA President Jack Herstein argued that crowdfunding would not even be necessary if entrepreneurs could easily get the funding they needed from banks. And since such easy funding from banks is readily available, then perhaps there’s something wrong on the entrepreneurs’ end.

“If a company cannot get financing from a bank, an SBA loan, a venture capital fund, or even friends and family, it is probably because there is a significant risk that the investment is extremely risky,” Herstein told Congress. “The critical questions are: Have these sources stopped funding small businesses? If so, why?

“If the answer is that funding is not available because banks are not lending as they should, or because traditional sources of small business capital are unavailable even to well-qualified, established, or very promising small business endeavors, then this has the potential to stifle small business growth and hurt the economy,” he continued. “Therefore, Congress might consider certain steps to minimize or remediate this needless loss of productivity. On the other hand, if the answer is that traditional sources of small business capital have reviewed the particular small business applicant and determined that the risk is too great, then we should not allow that applicant to seek investment from unsophisticated, ‘mom and pop’ investors without appropriate investor protections. The typical retail investor, unlike the traditional small business financier, does not have the ability to conduct a reasonable investigation of a start-up or development-stage entity.”

The Senate bill’s key sponsor is Sen. Scott Brown (R – Mass.), who suggested last week that “mom and pop” investors should have greater opportunities to fund “mom and pop” entrepreneurs without as many as 50 state governments standing in the way, arguing over jurisdiction.

“At a time when technology and social networks are shaping our daily lives and driving our economy to new frontiers, the small business and start-up communities are stuck with investor regulations that predate the first computer,” stated Sen. Brown. “With these fossil-like rules tying down our entrepreneurs, it’s no wonder a lasting economic recovery has been so hard to achieve. This bipartisan jobs bill seeks to replace outdated restrictions so that small businesses have new ways to access capital and can more effectively compete in the global marketplace. It cuts the red tape that prevents small businesses from connecting with investors and, while retaining important investor protections, opens the door for more Americans to invest in new companies and their cutting edge ideas. If we pass this bill, opportunities to invest in the next Facebook or Google won’t be limited to the most affluent Americans.”

It’s always sunny in Washington

Recent amendments to the Senate language could improve the chances for the bill among some opponents, who had previously sided with Prof. John Coffee of Columbia School of Law. Last week before the same hearings in which Sen. Brown testified on behalf of the bill, Prof. Coffee suggested that passage of the bill could lead to carpetbagger chaos. He suggested a compromise approach would prevent crowdsourced funds from actively soliciting potential customers, including via the Internet, and also make certain that any party that does solicit potential investments as well as customers register themselves with federal and/or state authorities.

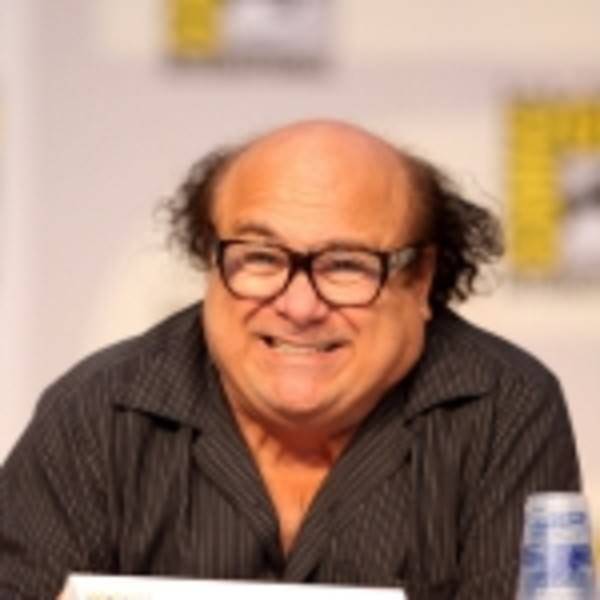

In an effort to make his testimony more memorable (which probably worked), Coffee added this: “Failure to adopt this approach or some similar variant would likely mean that every barroom in America could become a securities market, as some unregistered salesman, vaguely resembling Danny DeVito, could set up shop to market securities under the crowdfunding exemption. Under the current version of S. 1791, such a person could open his laptop on the bar, show slides of a half dozen companies to the bar’s patrons, and solicit sales. This will create few jobs – except for dubious unregistered salesmen – and much fraud.”

Under the amended bill, entrepreneurs could be introduced to the existence of such funds by way of so-called broker intermediaries, which may include consultants such as Sramana Mitra. Her One Million By One Million (1M/1M) initiative (not to be confused with a brokerage) has a goal of enabling one million entrepreneurs to obtain $1 million in investmentsannual revenue by 2020. Perhaps not coincidentally, the Brown bill would limit the total size of securities available through crowdsourced services to $1 million.

[Danny DeVito photo from ComicCon 2010 by Gage Skidmore.]