The then-newly installed chairman of the Federal Communications Commission, Julius Genachowski, said in October 2009, “We are fast entering a world where mass-market mobile devices consume thousands of megabytes each month. So we must ask: What happens when every mobile user has an iPhone, a Palm Pre, a BlackBerry Tour or whatever the next device is? What happens when we quadruple the number of subscribers with mobile broadband on their laptops or netbooks? The short answer: We will need a lot more spectrum.”

Yesterday, a systematic and mathematical analysis of U.S. spectrum allocation blatantly called Genachowski’s statement to the 2009 CTIA Wireless conference flat wrong.

Jason Bazinet and Michael Rollins of Citi Investment Research & Analysis concluded that only about 35.7% of spectrum set aside for wireless communications, is being used for that purpose. What’s causing the spectrum problems, Bazinet and Rollins believe, is not how much spectrum is being consumed but where it falls on the map, and who owns it.

“We do not believe the U.S. faces a spectrum shortage,” write the Citi analysts. “However, unless incumbent carriers accelerate their 4G migration plans, or acquire more underutilized spectrum, upstart networks – like Clearwire, LightSquared and Dish – could have a material speed advantage over incumbent carriers provided that they can clear meaningful hurdles for funding and distribution.”

A big chunk of the nation’s wireless frequency spectrum, they argue, is presently held by companies that have no plans, immediate or otherwise, to monetize it. They tally that 538 MHz of wireless spectrum has been allocated to U.S. firms, though some 192 MHz is actually in use. And according to their calculation, at least 90% of that amount is used for 2G, 3G, and 3.5G communications. Those older protocols are yielding transmission speeds of less than 1 megabit per second (Mbps) during peak usage hours.

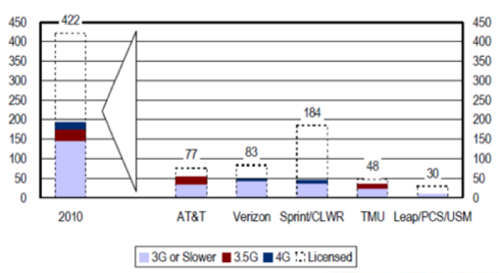

[Source: Citi Investment Research & Analysis]

The chart above depicts spectrum usage by the major carriers and holding companies as of 2010; the dotted lines represent the excess amount that’s allocated but not yet put to use. Note the huge space allocated to Sprint/Clearwire that’s still “untamed frontier.”

Citi’s calculations estimate that if carriers put all 538 MHz to use for 4G LTE transmission, those speeds could climb to 5 Mbps during peak hours, with only 10% simultaneous usage overlap between carriers.

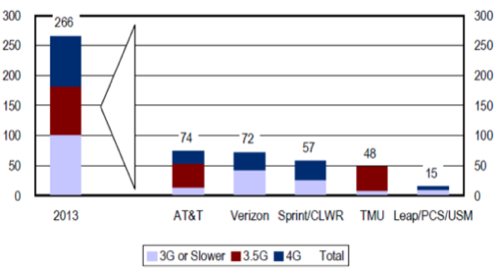

[Source: Citi Investment Research & Analysis]

Statistics used by the Citi analysts show the average data throughput for a 3G cell site to be 36 Mbps. A migration to HSPA+ technology (considered “3.5 G”) boosts that speed to 63 Mbps. Full conversion to 4G LTE skyrockets throughput to 258 Mbps, and Rollins and Bazinet admit that number could be even higher if the promises of LTE-Advanced come to fruition by 2013.

So what’s the holdup? The Sprint/Clearwire partnership has the biggest share, with phone carriers AT&T and Verizon Wireless making do with less. 4G technology requires larger contiguous blocks (20 MHz) than earlier generations. So Verizon and AT&T have room maybe for two LTE carriers before they find themselves having to borrow space from their 3G and 3.5G allotments – a process which ends up making services in that older space slower.

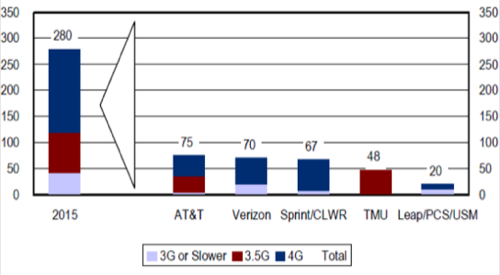

[Source: Citi Investment Research & Analysis]

While only a small percentage of wireless services use 4G today, Citi believes 4G could constitute as much as 57% of wireless traffic by 2015. A juggling process that anyone who’s ever optimized a hard disk drive may appreciate, which would include the FCC expediting auctions in the existing space, would enable carriers to utilize as much as 280 MHz of allocated space (still only 52%) without the need to annex additional spectrum space.

“One hundred percent conversion of 538 MHz allows carriers to offer 5 Mbps with 10% simultaneous usage during peak busy-hour. This speed allows for very robust mobile use and limited home use,” the Citi analysts conclude. “Too much spectrum is controlled by companies that are not planning on rolling out services or face business and financial challenges. And, larger carriers cannot readily convert a substantial portion of their spectrum to 4G services, because most existing spectrum provides 2G – 3.5G services to current users.”