Longtime technology innovation investment firm Battery Ventures increased its capital to over $4 billion Thursday as the firm announced the securing of its ninth fund at a value of $750 million. Startups and entrepreneurs may be able to look at 2010 with high hopes as Battery’s fund, one of the largest seen in the last year, comes after a period of decline in venture funding.

Battery Ventures, which operates out of Boston, Silicon Valley, and Israel, has been investing in tech innovation since 1983. The firm has helped several Internet companies launch initial public offerings (IPOs), such as the early search engine Infoseek, the web app platform Akamai, and analytics provider Omniture. In a press release Thursday, Battery partner Tom Crotty expressed his hope that Battery’s new fund signals a rebound of floundering investment dollars.

“After a slow investment pace industry-wide in 2009, we look forward to rounding out the portfolio of Fund VIII and initiating the investment cycle for our new fund,” said Crotty. “With improving market fundamentals, we believe the next few years will be healthy ones to put money to work.”

This fresh influx of capital for Battery, which equals the amount raised in their previous fund, should excite early stage startups who have been struggling to raise funding in the down market. Battery, which invests in all stages of companies, could be an excellent benchmark for what is to come in 2010. This new fund, along with other early signals this year, could be a precursor to a steady increase of VC funding.

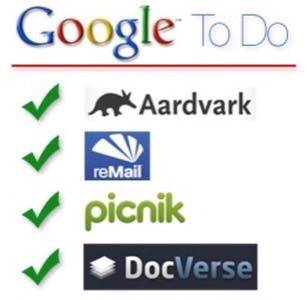

Google may be helping this as well, as the Internet behemoth is giving the M&A market a boost by snatching up companies left and right in 2010. So far this year, Google has acquired Aardvark, reMail, Picnik and DocVerse, all within the first 64 days of the year. In 2009, a year with poor M&A performance, Google only acquired 6 companies; at this year’s pace they could buy as many as 20, though they have been known to go on quick brief shopping sprees. In the early summer of 2007, they roped in 11 companies in less than three months, but only totaled 16 that year.

As the first quarter of 2010 draws to a close in a few weeks, it will be interesting to see numbers on how the M&A and venture capital markets are fairing. If Battery Ventures’ fresh cash and Google’s acquisitions are any barometer, things should be looking up for the rest of the year.