Given the U.S. economic crisis, people are looking for new and better ways to get a handle on their personal finances. We recently profiled 10 money management web applications that promise to do everything from analyzing your spending behavior to saving you money by negotiating lower rates on credit cards.

The proliferation of these types of apps would have you believe there’s a big demand for web-based financial tools. But is there really? We would hope so, considering how their advanced technology can provide detailed analysis about your money (or lack thereof). However, we secretly wondered if the only people logging in to sites like Mint.com and the like are the young kids of Gen Y. Do adults with mortgages, credit card debt, and 401Ks even know how to use these tools?

Are Banking 2.0 Users Really That Young?

To find out who’s using the banking 2.0 tools and why, we started with Mint.com, who recently gave us a peek into their company’s data. As VentureBeat noted, Mint.com’s nearly 500,000 users are cutting down on expenses – they’ve spent an average of $300 less per month in August than in January this year, a 6% drop. However, they believed that early users of this site and those like it were sure to be younger and more tech-savvy. We believe they are tech-savvy, too, since it does require the use of computer and browser, and we know that not everyone can handle such complications. But we wondered: how young are the users really?

Mint.com Is Slowly Aging

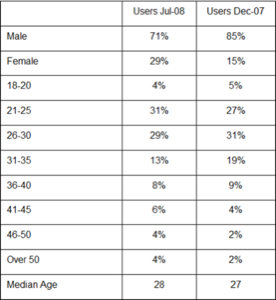

Although Mint.com doesn’t require you to fill out anything more than a zip code and email address in order to sign up, they’ve conducted multiple user surveys in order to get a grasp on their company’s demographic data. The end result of those surveys has given them a good idea of who uses the site.

Mint.com admits that they, as a web company, did indeed “launch young.” In the beginning, their audience was primarily Generation Y. However, over the past year, their user base has been gradually aging. At launch, the average age of the user on the site was 27, the same as their CEO at the time, Aaron Patzer. Today, the average age is 28, only a year higher, a year later. So are they really growing up?

Maybe they’re not aging overall as a site, but when you look at the breakdowns by age range, you can see that some of the older age groups are trending upwards. Look at the 40-year-olds and up, for example – there is some growth to be seen there. Below, you can see a chart that tracks changes between September, 2007 and July, 2008:

Another trend that points to the aging of Mint users is the fact that more users now report owning their primary residence. In December 2007, that number was 39%. Today, 43% report that they own their own home.

Why It Works: You Can Actually Save Money

When we first reported Mint.com’s announcement that they had saved users over $100 million while managing $12 billion in transactions, some of you were skeptical. But the company is maintaining those numbers are accurate. This is in part to due the fact that when you take into consideration the number of accounts maintained at Mint (checking, savings, credit card, 401K, mortgages, car loans, etc.) and the number of users (now about half a million), it isn’t very hard to push that number up. However, it’s also high thanks to Mint.com’s wealthier-than-the-average-American user base. As of July 2008, the user’s average income level was over $100,000/year and 39% had investment assets over $50,000.

But that’s not to say that Mint is only a tool for the wealthy tech elite – anyone can save money with the service. According to a company representative, 1 out of every 10 Mint.com users changes accounts after signing up for the service. This means that those users are tapping into Mint.com’s feature where the service recommends them a better offer. For example, a person with a credit card who charges a lot of airline tickets might be offered a different card with travel points. Another person might be recommended to switch from their Bank of America savings account to ING where they would get a better rate, perhaps. And yet another person might be recommended a credit card with a lower rate. And don’t be mistaken – those recommendations aren’t simply taking into account the introductory period where the credit card company slashes the rate to entice you, but looks at the credit card rate over the course of an entire year before determining whether it would really save the user money.

What About The Other Startups In This Space?

Given Mint.com’s user base of around 500,000 and their traffic numbers, they are one of the biggest, if not the biggest, personal finance/money management web service. They achieved this growth through smart advertising campaigns that reached out to the mainstream, especially women, in magazines like SELF, Real Simple, and Reader’s Digest. That appeared to have worked – today, 40% of new users on the site are women – that’s a much higher number than back in 2007, when only 15% of the users were female.

So, what about the others? We reached out to some of the other banking 2.0 sites to see what sort of data they had, too. Out of the ten apps we previously featured, only Wesabe, Rudder, Geezeo, Xero, and Expensr had data on hand. iThryv is still preparing to launch and the rest did not respond to our request.

Here’s how those sites compared:

- Over 100,000 users

- 56% male, 44% female

- Median income: $60-80K

- Age: 60% are 30 or younger

- Misc. – 75% have a college degree or higher, 43% are married

- The company just launched at DEMO last month, but already have 15,000 users.

- They don’t collect demographic info.

- 30,000 users

- 54% male, 46% female

- 30% 18 – 34 years old

- 38% 35 – 49 years old

- Site attracts less affluent users

- More info here

- Xero has 2200 paying customers

- Their number of customers has grown 132% since March 31, 2008

- Xero will not disclose demographic data.

- 25,000 users

- Users in their 20’s: 66%

- Users in their 30’s: 24%

Great Tools, Now If Only Banks Would Tell People They Existed…

Overall, we can tell there are some general trends here – banking 2.0 sites are still young, but are starting to gain traction among older users. More women are starting to use these applications which makes sense, give that they are typically the ones holding the household purse strings.

However, we think that there should be more of a push by financial institutions to recommend these types of tools to their customers, instead of sticking with the old stand-bys that include desktop software applications like Quicken. As Alistair Newton, Research VP and Industry Services Director at Gartner noted earlier this year, “with banks coming under increasing pressure to deliver a range of short-term cost savings, the ways that banks interact with their customers will become increasingly important in managing costs downwards. There are a variety of ways in which banks can help customers save money and better manage their exposure to debt while saving the bank money by encouraging greater use of self-service applications.”

Gartner also maintains that communities such as Mint.com, Wesabe, and Geezeo can be of long-term benefit to banks, especially as they help the more debt-exposed clients to manage their funds more effectively.

We couldn’t agree more. Our hope is that in light of the country’s economic meltdown, these apps will get the push they deserve.

Image credit: Cash, courtesy of: spcbrass