OpenStack, the cloud’s community darling, desperately needs leadership, and Red Hat seems the ideal leader. But OpenStack isn’t the only needy party here. As good as Red Hat’s growth has been over the last decade, it pales in comparison to that of VMware, a later entrant that has grown much faster than Red Hat. And the open source leader still trails well behind Microsoft.

See also: Why OpenStack Needs Red Hat

In short, Red Hat needs the OpenStack-based private cloud just as much as the OpenStack community needs Red Hat. But neither will be sufficient without factoring in Amazon Web Services (AWS) as the dominant public cloud deployment target for developers.

Can Linux Drive Red Hat’s Next Billion Dollars?

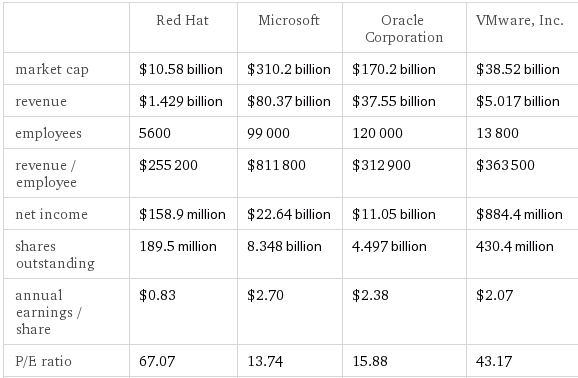

Red Hat has shown impressive growth and profitability over the past 10 years, most recently reporting quarterly revenue of $397 million, up 15% over the same quarter last year. Great as this is, it doesn’t really match the best of Red Hat’s proprietary competitors. VMware was founded in 1998, a year before Red Hat went public, but now generates nearly four times as much revenue and is worth nearly four times as much. When a proprietary software model works, it really works, as can be seen from this Wolfram Alpha comparison of Red Hat, VMware, Microsoft and Oracle:

While such a comparison isn’t completely fair, given that Microsoft and Oracle have been around for decades, “fair” doesn’t really factor into customer purchasing decisions.

So it must be somewhat worrying to Red Hat that the disruptive force of Linux in the enterprise is over. That’s not to say Linux has trounced Windows, but rather that in the enterprise, the market share that could be stolen away from Unix and Windows has largely been taken.

Unfortunately, what’s left may not be worth as much. As far back as 2009 I wrote that non-paid Linux could end up hurting paid Linux adoption. According to J.P. Morgan Equity Research in October 2013, “Linux is gaining installed base share twice as fast as revenue share.” If anything, this trend will accelerate.

Red Hat CEO Jim Whitehurst has been quick to point out that enterprise workloads are trending toward Linux, and whether paid or non-paid, Red Hat ultimately benefits because the top non-paid Linux distribution is CentOS, a Red Hat Enterprise Linux clone. So even those that don’t pay Red Hat for Linux may end up paying it for virtualization or other software higher up the stack.

Still, it’s hard to imagine the operating system—any OS—really driving a big business anymore. Especially as we move to the cloud.

Beyond Linux

Indeed, it’s the cloud that Red Hat needs to drive its next billion dollars—more than virtualization, PaaS (Red Hat’s OpenShift offering) or anything else. JBoss, Red Hat Enterprise Virtualization (RHEV) and more all factor into Red Hat’s revenue goals, given that each individually takes on offerings from VMware, Microsoft and others. But Red Hat isn’t taking a piecemeal approach to competing. It needs a holistic cloud strategy, which is why OpenStack matters.

Red Hat executive vice president Paul Cormier told ReadWrite the cloud will drive the next decade of growth at Red Hat, but only recently has it become clear why this must be so, and how dependent on OpenStack Red Hat is to make it work.

Red Hat prefers assets that nobody really controls or that it can buy on the cheap. OpenStack is a perfect fit for Red Hat. With OpenStack, Red Hat gets free marketing, a bunch of hardware certification and support from hardware vendors, a gaggle of open source developers and the brutal reality that no one else has managed to get the code working consistently well for a mass market audience.

Red Hat knows this playbook well. The Red Hat value chain for Linux is Linux.org -> Fedora -> RHEL. When it comes to OpenStack, we could see a similar trend. OpenStack produces code, Red Hat creates some “community edition” of it, and then Red Hat ships a hardened version to enterprises. Indeed, this has already started happening.

The problem then is that to succeed, OpenStack must mature and evolve very fast. But for Red Hat’s model to succeed, there will be a time lag of a few months or years between community code and enterprise binaries.

Making OpenStack Pay

How will this conundrum be resolved? It’s not clear. Red Hat can’t afford to wait too long for OpenStack to become viable, because in the meantime VMware and Microsoft are expanding their cloud footprints. Nowhere is this more true than in the so-called hybrid cloud.

Microsoft has a reasonable value proposition for hybrid clouds today. VMware has a new hybrid offering that may work as long as they get the public cloud side up and running properly. AWS and Eucalyptus represent a hybrid couple.

With whom will Red Hat “hybridize”?

Red Hat’s model is to be open to all deployment targets, as Cormier mentions with regard to PaaS:

The problem with the other PaaS providers is that if you build on any of the other PaaS solutions, whether it comes from Google or someone else, you’re not getting the application out of their network. Ever. The app is only going to run on their network. Customers don’t want this. They want to own the future of their application. Red Hat gives customers this ability by providing a consistent platform across different deployment targets.

The easy public cloud partners would be other OpenStack providers like Rackspace or HP. But given the dominance of AWS, it’s the most likely public cloud partner. The upside is that this is what customers using the public cloud have so far wanted. The downside is that this cedes control to Amazon.

Oh, and the other downside is that thus far no one has built AWS compatibility into OpenStack. More worryingly, with each new OpenStack release, this interoperability is becoming harder and harder to achieve.

CloudScaling is trying to make OpenStack AWS-compatible, but this has had no effect on the OpenStack ecosystem or the foundation. Its developers continues to see themselves as a defense against AWS, so they refuse to follow the de facto standard of AWS APIs. Being API-compatible requires both syntactical and semantic similarity, and the latter is the more difficult part. It will take years, and it may not be possible any longer.

Will Red Hat Force AWS Compatibility For OpenStack?

Given how much cloud computing is shifting to the public cloud, Red Hat’s OpenStack story may well depend upon Red Hat forcing AWS compatibility into OpenStack. As the company that wants to “provide a consistent platform across different deployment targets,” it can’t afford to ignore the target that may come to include as much as 80% of public cloud workloads.

Red Hat’s role is to broker both old workloads and new, from Linux to OpenStack…to AWS. Red Hat is betting that on-premise enterprise datacenter deployments will continue to provide it with a good business. To claim this evolving space they focus on OpenStack and OpenShift. But to claim the broader shift to public cloud Red Hat must also embrace AWS, which means it’s going to need to make OpenStack play nicely with AWS.