Most people would agree that Amazon has turned itself into a pretty amazing company. It has turned itself from an e-commerce bookseller into one of the most dynamic companies in the world, providing content for the masses, infrastructure for the Internet and a manufacturer of an array of tablets and e-readers that have helped change the way we read books.

Yet, there is one battle where Amazon has little chance of winning. The battle for App Supremacy.

The Amazon Appstore for Android expanded its global footprint this week, spreading its reach to 200 countries. One might think that Amazon, considering its acumen at selling content like books, movies and music, would be a perfect fit to dominate the app space. But, if Amazon is going to climb to king of App Mountain, it has a long, hard way to go.

(See also Do We Really Need Amazon TV? No, But Amazon Does.)

Appstore Gaining Traction

Amazon’s value proposition for its Appstore is pretty clear: if you own a Kindle Fire, you get a curated set of apps that work specifically with your tablet. It is when Amazon tries to extend beyond its own gadgets is where potential is stifled. Amazon Appstore for Android can be downloaded to just about any Android device, but as we have seen with other secondary app stores (Samsung or Verizon), being the second app store is not a recipe for success.

Despite not being readily available on most Android devices, Appstore continues to gain traction. A new report from app analytics firm Distmo reveals that in the U.S., at least, the “Amazon Appstore is rapidly becoming more and more competitive with Google Play” especially for paid apps.

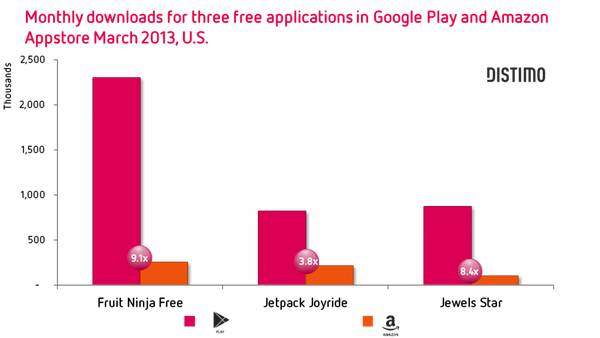

For raw numbers, Google Play has about 800,000 apps. Apple’s’ App Store is about the same. The Amazon Appstore? 75,000. Yet, app volume is a bit of an inconsequential argument. Downloads are what matter. In that area, Amazon is not fairing poorly. For example, Distmo found that Google Play is “ten times” bigger than Amazon’s Appstore in terms of total app downloads. The graph below shows the large gap in free downloads between Play and Appstore:

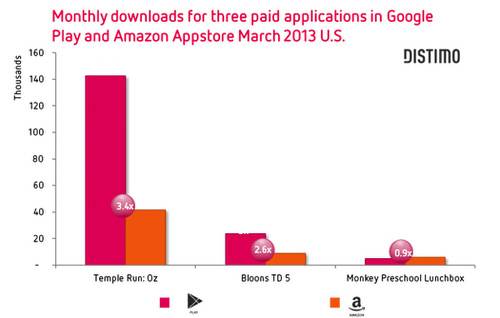

In paid downloads, however, Google Play is only twice as big as the Appstore.

The gap is even narrower when comparing revenues. “The top 200 paid applications in Google Play in the U.S. made $5.2 million in March 2013. This makes Google Play 1.7 times bigger Amazon Appstore.”

Amazon is also continuing to expand the Appstore’s reach. In 2012, Amazon launched Appstore in the UK, France, Germany, Spain, Italy and Japan. Earlier in April, Amazon announced it was expanding Appstore to 200 countries.

Does that mean Amazon’s Appstore could someday unseat Google Play? Not likely.

Amazon’s Reality Check

Apps and developer relations are not a core competency for Amazon. The first year of the Appstore was marred by controversy and setbacks with developers, especially concerning the “free app of the day” promotion that gives the Appstore its biggest value bet for consumers.

Update: Amazon refutes the claim that developer relations are not a core competency. Through Amazon Web Services, the company does have significant developer relations in its corporate blood. Yet, when it comes to developer relations in regards to the Appstore, that has not always been the case.

From Amazon communications, Rena Lunak: “Amazon has very deep experience and success with developers via Amazon Web Services, specifically. In fact, the web scale computing services that Amazon Web Services offers today are based on Amazon’s own back-end technology infrastructure which we’ve spent over a decade building into one of the world’s most reliable, scalable, and cost-efficient web infrastructures. TinyCo, EA, Halfbrick (makers of Fruit Ninja), Red 5 Studios (makers of FireFall), are just a few well-known app and game developers using AWS to ensure they can scale quickly and cost-effectively to meet customer demand.”

Developers are still wary of the Amazon Appstore. Greg Raiz, founder of Raizlabs, an independent app studio in Boston, said that his firm has “experimented with the Amazon store and found minimal traction with apps that are deployed there.

Consumers don’t feel they need an alternate store so they don’t actively install it. Amazon did get some consumers to install their store experience by offering a “free app a day” promotion. This had some novelty but hasn’t impacted developer mindshare in any significant way.

Only Amazon’s Kindle Fire tablet line comes pre-loaded with Appstore. For everyone else, Amazon’s Appstore requires users follow the company’s “detailed instructions” to determine if their specific Android device can even support Appstore, then to download and install it.

Just as important, mainstream Android apps require additional coding to ensure compatibility with Amazon’s forked version of the Android operating system for Kindle Fire, and integration with Amazon’s store and payments services. It shouldn’t come as surprise that a recent survey of 1,500 app developers by app analytics firm App Annie, found that only 22.5% of respondents were publishing to the Appstore.

Google’s Android Strategy Works

Amazon has done well to create a market for its Kindle Fire tablets and, by extension, its own Appstore. Yet, a limited market share makes for limited potential. At the same time, Amazon faces stiff competition from the likes of Samsung and other Android manufacturers for consumer mindshare. The most used Android tablets are not made by Amazon. They are made by Samsung.

Amazon is a digital content powerhouse, particularly in the U.S. In its official earnings statement this week, the company noted its extensive content creation and distribution prowess – in theory, apps shouldn’t be any different – it’s all just digital content to be packaged, sold and delivered. But Google’s Android strategy – giving away the operating system pre-packaged with Google services like Search, Maps – and Play – gives the search giant a level of scalability and device compatibility that Amazon simply cannot match.