Who knew that IBM’s sales team was so bad? Or Oracle’s? Or Tibco’s? In a string of earnings calls, each of these titans of enterprise software put their respective sales teams to the sword, blaming them for the companies’ poor earnings reports.

If only it were that easy.

Shooting The Sales Messenger

While we’ve talked about the decline of legacy software vendors for years, it’s only now that the rise of cloud and open source are showing up in the earnings reports of legacy IT vendors. First it was Oracle, signaling an end to the traditional enterprise software licensing model. Then Tibco. Now IBM.

As IBM chief financial officer Mark Loughridge argued,

We had solid profit performance in January, but as the quarter ended hundreds of millions of dollars of very profitable software and System z mainframe deals fell short of the goal line. On the software side of the house they had a very good listed deals and I think this was just pure execution. We should have closed those on a sales side.

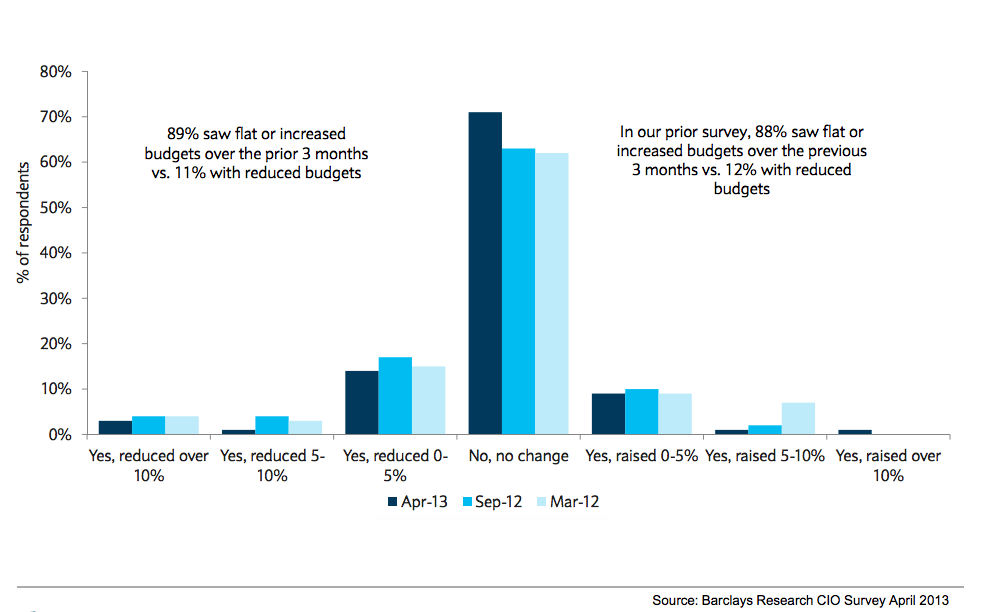

It would be easier to believe this if similar results (and excuses) weren’t popping up across the legacy IT vendor landscape, and this despite a flat to improving spending outlook by CIOs, according to recent Barclays survey data:

Perhaps the problem isn’t the sales teams’ execution – a “lack of urgency we sometimes see in the sales force” as Oracle president Safra Catz opined – but rather the very foundation for legacy enterprise software sales: the software license.

It’s The Data, Stupid

As Redmonk analyst Stephen O’Grady persuasively argues, the value of software as software has been declining for years. Value has been shifting to data, and software has either become free (open source) or distributed services made available over the web (cloud). Software revenue growth for the big vendors, not surprisingly, has slowed to a trickle, according to IDC data.

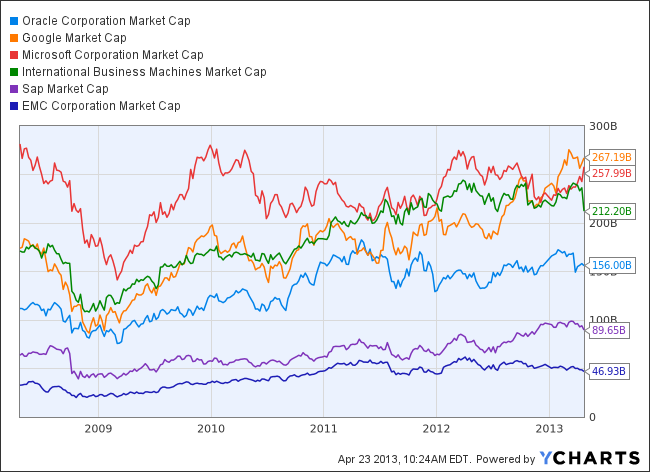

This shifting emphasis away from software sales, toward data-based services, has crowned Google as the market capitalization leader among its “peers,” a trend that will likely continue for many years:

In fact, as O’Grady highlights, among the PWC global top-100 software vendors, none of the top-20 was founded after 1989. He concludes: “The data is clear: while there is substantial money in software, the difficulty of employing it as a primary revenue mechanism is increasing.”

A Flight From Software To Cloud

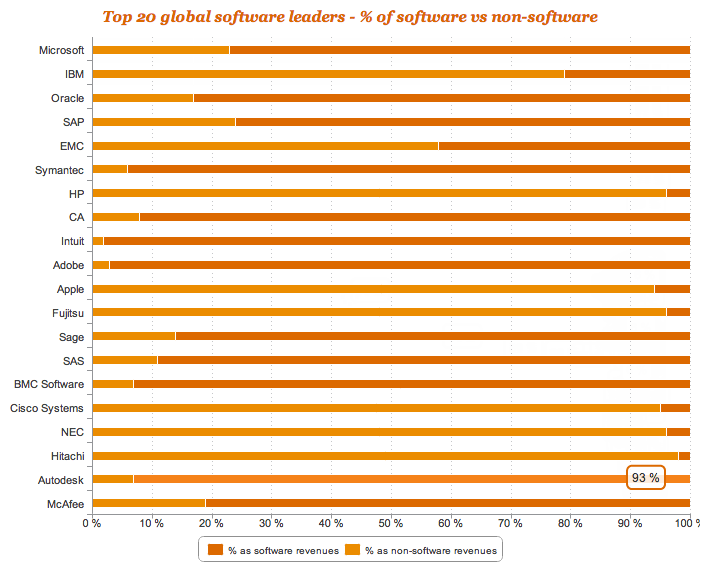

For this reason, we’ve seen IBM and others diversifying out of software, bulking up in services, differentiated hardware, and more, as PWC’s segmentation of software revenue among the world’s top-20 software vendors indicates:

Such a shift won’t happen overnight, and will be painful along the way. Very painful.

For example, SAP has been struggling to become a cloud-friendly company, and it’s having deleterious effects on its earnings. As Wells Fargo analyst Jason Maynard spotlighted in a recent SAP research note, “increasing demand for cloud solutions is creating a negative drag on software license revenue growth.”

Having lived through this at Novell, when we had to replace super high-margin NetWare revenue with lower-margin, lower-priced SUSE Linux revenue, I can state with some certainty that it’s a long, tough road (fortunately, one that SUSE seems finally to have completed). Still, some companies, IBM in particular, have managed to make the transition, though no legacy IT vendor has gone to the lengths that Google, Facebook, Salesforce and other new-breed “tech” companies have, essentially making the sales function an automated credit card transaction over the web.

This friction-free, license-free model is the future.

In this new world, purchasing power moves away from CIOs to developers, in the case of open source, and to line of business executives, in the case of cloud. Where it’s not moving, and likely never will again, is to the top lines of the legacy IT vendors. Software has become a service, not a big revenue driver. That fact won’t change, and shooting the sales messenger won’t help.

Image courtesy of Shutterstock.