An investing strategy completely based on social media sentiment won’t make you rich, but stock-focused social media can boost your education as an investor and offer tips for further research. Read on for our blue chip pick of the best place on the Web to connect with other investors.

By now we know that social media can’t predict the ebbs and flows of the stock market with 100% accuracy – at least not yet. Using social media sentiment as part of an investing model seems to have its advantages, but the research is preliminary and the field is in its infancy.

But that doesn’t mean we should discount social media as part of our overall investment strategy. There is something to be said about the future of social media sentiment stock picking and, in the meantime, investing-focused sites remain a great way to find tips for further research and just up your investor knowledge.

There are dozens of upstarts out there, including previously reviewed Motif Investing and StockTwits, as well as TradeStreaming, which aims to connect investors with experts, and WealthLift, which also accents the idea of investment education based on a community approach. But when it comes to money and risk, there’s something to be said for experience and longevity.

Our Recommendation: The Motley Fool

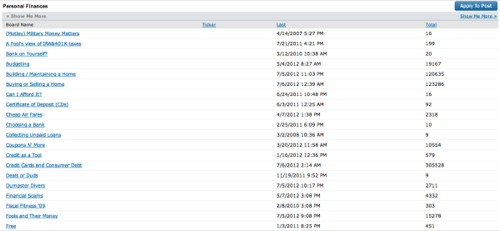

Founded in 1993, the Motley Fool is one of the oldest and most-respected investing communities on the Web. Yes, the message boards seem a bit antiquated when compared to some of the bells-and-whistles offered by the newer social media sites, but Fool was a social-investing site before social media was a Web buzzword, and its community of investors remain active and, in our experience, helpful.

On top of that, Fool offers loads of free and subscriber-only content, expert commentary and stock-tracking tools. The Fool also offers something else: a consistent message. While other sites have chased the Day Trading trend of the later 1990s and jumped on the IPO-hunting bandwagon of the early part of the decade, its community has always been built around the idea of championing individual investor rights and removing the complex jargon that convinces individuals that investing is something best left to the pros.

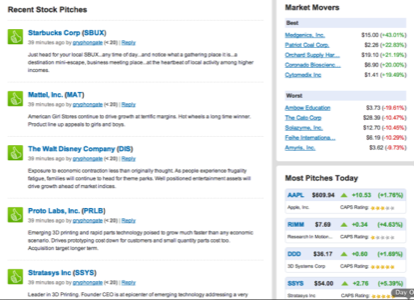

We’re particularly fond of their relatively new CAPS Community, which measures social sentiment (as well as the opinions of more than 100 Wall Street firms) to give capsule reviews of whether or not a stock will underperform or outperform the market.