The investment analysts at CB Insights have released their quarterly report on venture capital activity, and in terms of deal-flow and funding levels, the news is good. The first quarter of 2011 saw these return to their pre-recession levels with financing for Internet companies up 83% from the last quarter of 2010.

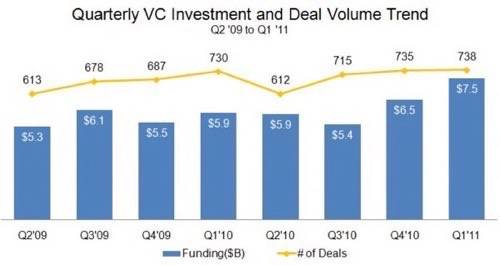

According to the deals tracked by CB Insights, 738 deals were funded in the first quarter, with a total of some $7.5 billion in VC investment. That increase will be used, of course, as “proof” that there’s a bubble. It’s a one billion dollar jump from the previous quarter, even though the number of deals has sad the same. That’s just one interpretation of the statistics, of course.

It’s worth pointing out here that part of the surge can probably be attributed to the massive $950 million funding received by Groupon. While about half of that was included in the fourth quarter of 2010, the rest was counted in this first quarter of 2011.

You can view the entire CB Insights report here, but here are a few highlights:

Seed is Strong

Early stage deals and funding were about the same this past quarter as they were in the last quarter of 2010, with seed VC funding accounting for about 10% of overall deal flow. This figure has stayed consistent for the last four quarters. But when you look at activity, it’s worth pointing out that early stage deals account for almost half of all deals done.

Breakdown By State

Go Groupon, Go Illinois

Illinois, the home state of Groupon, saw an increase in the number of investments occurring in the area. While Illinois has never really been a major player in terms of activity or funding, CB Insights says that the state has shown “increasing signs of life since Groupon-mania began.”

New York, Number 2

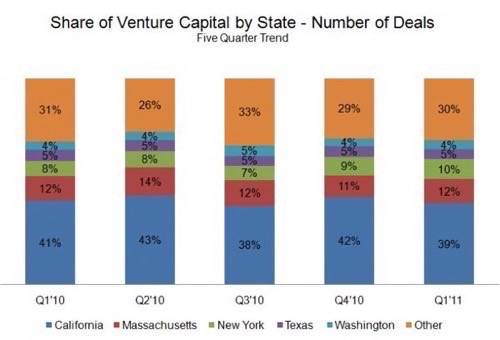

Sorry Massachusetts, New York has pulled ahead in VC funding. Over the last six quarters, New York has seen 261 tech deals, coming in at about $1.6 billion as compared to 250 deals and $1.44 billion for Massachusetts.

Go West. Go California

No surprise here, but California continues to dominate the number of deals and the amount of funding. California accounted for about 39% of deals and over 50% of funding in the first quarter. The funding was up 47% from the last quarter of 2010, but the number of deals were down.

And Texas and Washington?

While the news is good out of Massachusetts, some of the other states that have long been known as tech centers didn’t fare so well. Funding was up in Texas, but the number of deals were down. And while the number of deals were up in Washinton, VC funding in the state hit a five quarter low.

Based on this more nuanced and detailed look that CB Insights provides, can we still read the statistics as a sign of a bubble?