Since 2002, the law form of Fenwick & West has conducted a venture capital survey, a response to “the burst of the ‘dot-come bubble’ and a desire to provide the entrepreneurial community with objective information about the status of the venture environment.” But recognizing that the funding landscape has changed – more angels, more Web startups – this year the firm conducted its first Angel/Seed Financing Survey.

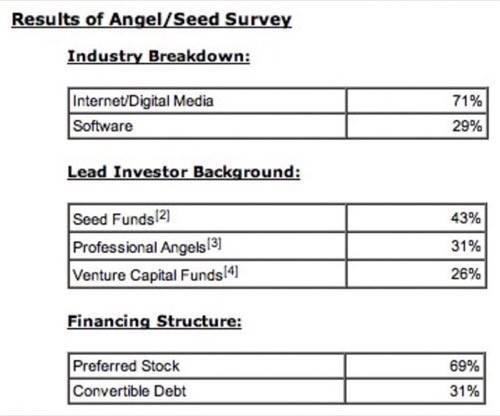

The survey includes responses from 52 Internet, digital media, and software companies that raised money in the Silicon Valley and Seattle in 2010. For purposes of the survey, this meant those companies raising their first round, between $250,000 and $2 million, led by a professional investor.

Fenwick & West say that the survey demonstrates a shift in the composition of investors at this stage, from “friends and family” to a larger percentage of seed funds, venture capital funds, and professional angels investing in early stages. Seed stage funds led 45% of the financings, individual angels led 31% and venture capital funds led 24%.

The majority of financings was structured as preferred stock (69%), as opposed to convertible note financings (31%), and the vast majority of those (83%) had their conversion price capped.

The median amount raised in preferred stock financings was $1.1 million and $600,000 in convertible note financings. Investors took a board seat in approxmiately 70% of preferred stock financings, but in less than 10% of convertible note financings.

You can read the entire results of the survey here.