Now and then a polarizing topic will make its way through the venture capital industry and several prominent investor/bloggers will chime in with their collective opinions in quick succession. Tuesday night TechCrunch’s Michael Arrington dropped a bomb on the industry, accusing Silicon Valley’s top angel investors of a collusion and price-fixing conspiracy. It goes without saying that while some intentionally chose to avoid the issue, many important VC industry voices have made their opinions heard on the topic this morning.

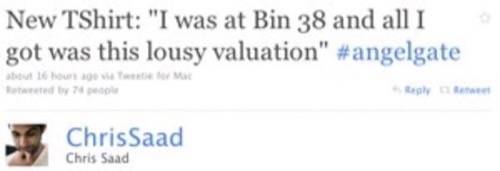

Monday evening, Arrington crashed a meeting of “ten or so of the highest profile angel investors in Silicon Valley,” at San Francisco restaurant Bin 38. According to Arrington, who says he spoke with some of the participants following the meeting, the angels were colluding to keep deal valuations down and to keep traditional VCs out of deals, among other things.

Wednesday morning, 500 Startups founder Dave McClure, pictured at top, (who has openly admitted to attending the meeting and is the most outspoken source for what may or may not have actually happened) refuted Arrington’s claims on his blog in the colorful, no-nonsense manner in which he addresses most issues.

“Yesterday I was invited to a dinner with some well-known startup investors to discuss the latest and greatest in tech and startups. The agenda was drinks, good food and shooting the shit… It wasn’t to collude, to price fix, to put out a hit on Paul Graham or generally bust a cap in any founder’s ass,” writes McClure.

He adds that “10 million other things” were discussed at the meeting, including convertible notes, valuations and term sheets. The group also discussed helping startups gain more access to capital, improving the M&A market and boosting innovation, says McClure.

Bryce Roberts, managing director at O’Reilly AlphaTech Ventures, also says he was there, and agrees with McClure’s account of the meeting.

“The dinner I was at didn’t have agreement on anything, let alone agreements and pacts as outlined in [Arrington’s] article,” said Roberts on a Quora thread dedicated to the issue. “The dinner I was at had investors who preferred bridge notes and those who preferred priced rounds. Investors who’ve backed YC companies and those who haven’t. Investors who like working with big VCs and those who prefer quick flips without getting traditional VCs involved. […] The dinner I was at reflected a bunch of different styles, not consensus.”

Based on these two first-person accounts, it seems that the meeting may not have been as incendiary as Arrington’s article indicates. Maybe. At this point it’s his word against theirs, but what is the actual likelihood that the Valley’s best and biggest angels would attempt to price-fix? According to VC wise man Fred Wilson, it’s not very likely at all.

Wilson says that VC firms “have been accused of colluding for years,” and that he’s “seen it first hand.” He adds, however, that it has been years since he’s seen this activity, and that the state of the market today makes it close to impossible to pull off at all.

“The very fact that some of the most active and respected angels in Silicon Valley were meeting to discuss the changing dynamic of their business suggests to me that the opposite is happening,” he wrote Wednesday. ” This is not a market suffering from collusion. It is a market where the investors wish they could inject some collusion. But they can’t and they won’t. Market dynamics, at least as they exist today and for some time to come, will not allow it.”

With that perspective, it seems even more unlikely that the sole purpose of the meeting at Bin 38 was to arrange some sort of “super angel” price-fixing scheme. But, stranger things have happened in this world, so it’s a bit early to definitively say what is or isn’t happening with these angels. Let us know what you think, however, by leaving a comment below!

Photos by Robert Scoble and Joi Ito