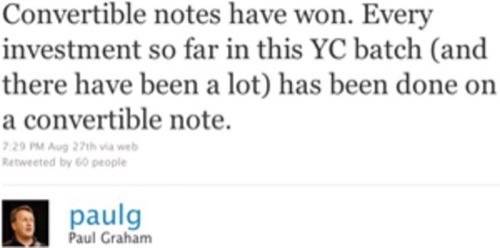

In the latest example of VC chatter – wherein multiple venture capitalists simultaneously blog about a hot issue – the topic du jour is the debate between convertible debt and equity rounds. The spark came from a Friday night tweet by Y Combinator founder Paul Graham (yes, he finally joined Twitter) that declared convertible notes victorious since each of this summer’s YC class opted for them. This morning, several VCs have weighed in on the issue, so here’s what entrepreneurs and early-stage startups need to know about the debate.

Firstly, what is convertible debt and how is it different from a normal straight equity investment? Foundry Group’s Seth Levine was the first VC to blog about the issue today, and he does a solid job of laying the cards out on the table.

“Convertible debt is exactly that – debt which is convertible into equity at some later point in time (or is paid off),” writes Levine. “Preferred equity is stock which carries with it certain rights (preferences) in terms of how and when it gets paid back and a handful of other items that relate to the control of the underlying business.”

Short Term vs. Long Term

As Levine explains, he sees the current convertible debt trend as a short-term positive for entrepreneurs because it delays the awkward valuation discussions and can provide an early boost to a company’s value. In the long-run, however, Levine is less optimistic about the viability of convertible debt.

“In larger rounds I think equity makes sense so that everybody agrees to the terms up front. On smaller rounds, why don’t we just do ‘convertible debt with price’ and everybody can be happy?”

– Mark Suster

“With capital being relatively fluid (and the angel markets being finicky) as companies run into trouble, as valuation caps begin to be disrespected, as overall return profiles decrease because of higher early stage prices, money will flow out of the asset class. And ultimately this doesn’t benefit entrepreneurs either,” he says.

Fast Deals & Company Control

Mark Suster of GRP Partners responded to Levine’s post with one of his own detailing his similar, yet alternatively justified views on the matter. One of the largest reasons Suster sees for accepting a convertible deal as an entrepreneur is to get a deal done quickly, which keeps legal costs down and puts more cash in the hands of the company.

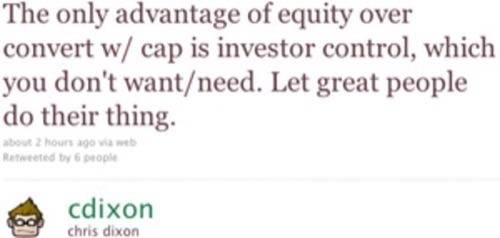

Also weighing in this morning is investor and Hunch co-founder Chris Dixon who tweeted a few gems of advice on the issue. He believes the best option for seed investments (of which he has made several) is convertible debt with a price cap because it “gives investors economic rights but not control rights and keeps legal fees down.” Additionally, Dixon notes that this keeps control where it belongs; “Let great people do their thing,” he says.

Trend in a Fluctuating Market

As for whether convertible debt has “won” as Paul Graham suggested on Friday, both Levine and Suster see the trend as just that – a trend. Levine points out that while many west coast investors are making convertible deals, many others are not. Suster says that convertible debt is popular when the market is thriving (e.g., right now), while down markets are prone to priced equity deals.

Perhaps all Graham meant was that convertible notes had “won” at Y Combinator. The general consensus elsewhere seems to be that these types of investments aren’t the end-all be-all of early-stage investing, but do indeed have their place and can be used on a case-to-case basis depending on the market.

“In larger rounds I think equity makes sense so that everybody agrees to the terms up front,” writes Suster. “On smaller rounds, why don’t we just do ‘convertible debt with price’ and everybody can be happy?”

I’m curious to hear what the people across the table from these VCs think about the debate between convertible debt and priced equity. As entrepreneurs, which sounds more attractive to you and why? Let us know how you feel in the comments below!