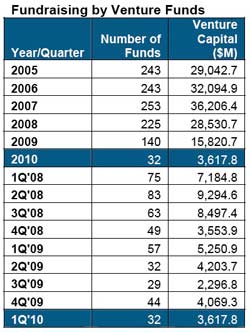

Though rising numbers from the final quarter for 2009 had many hopeful that 2010 would see a rebound of venture capital funds, new data from the Nation Venture Capital Association (NVCA) is bound to disappoint as Q1 2010 saw the lowest first quarter numbers (PDF) in 17 years. According to the NVCA, just $3.6 billion has been raised so far this year by VCs compared to $5.2 billion in 2009 and $7.1 billion 2008.

Back in January, we postulated that the uptake in fundraising by VCs during the final quarter of 2009 could lead to increased VC spending in 2010. The first quarter did see record breaking merger and acquisition numbers, but as NVCA president Mark Heesen points out, the IPO market continued to struggle – a fact he says may have contributed to the new low numbers for VC funds.

“Over the last two years, alternative asset allocations have declined and the exit market has suffered, putting venture firms in the unenviable position of communicating their value in an extremely challenging environment,” says Heesen. “Many firms have been waiting until the exit market improves before embarking upon their fundraising efforts.”

Heesen does, however, expect that these numbers will improve over the course of the year following the lead of the M&A and IPO markets which have already shown signs of improvement this year. The NVCA believes that most VC firms will be able to continue to raise funds in 2010, especially as the year continues, but also warns that the industry is headed towards an era of consolidation with smaller firms merging with larger funds or shutting down all together.

For startups, the recent numbers are certainly disconcerting, but there is still plenty of venture capital out there, just not as much as there used to be. Right now the VC industry seems very shaky, as analysts attempt to read the tea leaves to make predictions about the future, but entrepreneurship still has its room for opportunity. Quality companies will still find funding, so for startups, the main goals to focus on when seeking funding are building a quality product and ensuring your investors of a profitable future.