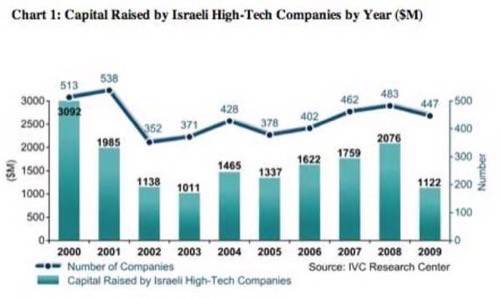

American startups are not alone when it comes to the well of venture funding drying up. A recent report by the Israel Venture Capital Research Center has found that funding in Israel fell drastically to $1.12 billion in 2009, nearly half the amount from the previous year. The 46% decrease marks the lowest funding numbers since 2003 and ends Israel’s streak of three consecutive years with increasing number of companies and funding dollars.

The numbers are a sign of the worldwide economic stress that is affecting countries large and small across the globe. While funding plummeted between 2008 and 2009, the number of companies funded only fell roughly 7% from 483 to 447, which means less money is being given to each company. In the fourth quarter of 2009, the average financing round was just $2.2 million, down from $3.61 million during the same period in 2008.

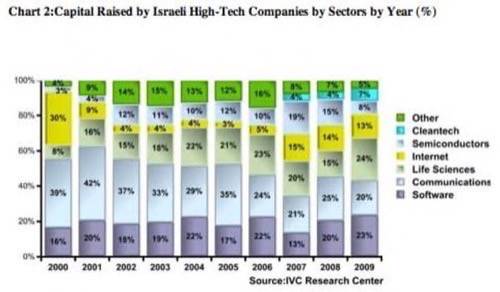

By sector, life sciences saw the most growth took the lion’s share of the money up from 15% in 2008 to 24% in 2009. Semiconductors in Israel continued a downward trend, falling from 15% of the funding in 2008 to just 8% in 2009, its lowest share since 2001. The internet and communications sectors held steady at 13% and 20% respectively, but they are nowhere near their numbers from 2000 when they combined for almost 70% of the total funding.

As reflected in the report, Israeli venture firms tend to favor mid-stage funding over seed funding by a great margin. In the fourth quarter of 2009, mid-stage companies accounted for over half of the funding, while seed companies gained just 4% of the total.

We recently reported that the fourth quarter showed hope for American startups, both in mergers and acquisitions and venture funding. For comparison, the United States saw over $20 billion in venture funding for 2461 deals in 2009, an average of nearly $8.5 million per deal.

With venture funding seemingly drying up in Israel, the United States could see an influx of foreign entrepreneurs coming to American for venture funds. Of course, this could be expedited by the creation of a startup visa program, a topic we wrote about earlier this month.

Photo by Flickr user hoyasmeg.