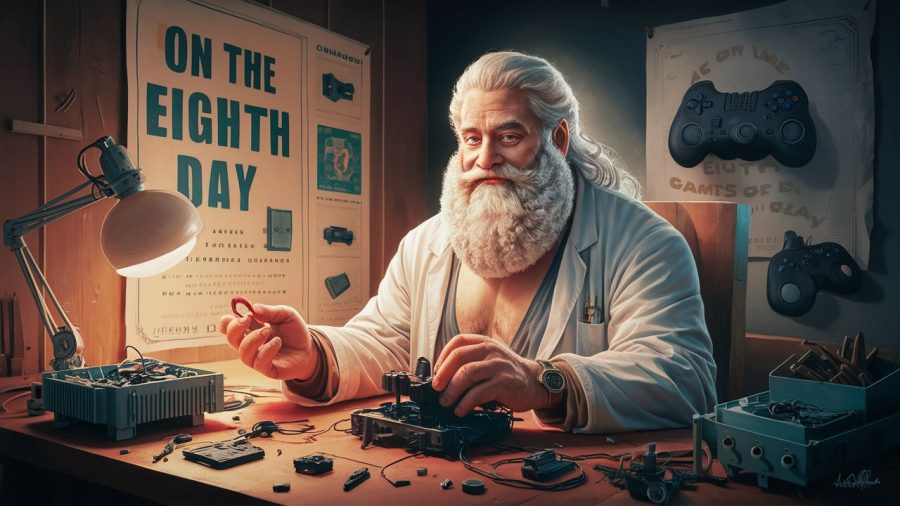

After successfully selling MyBlogLog to Yahoo, it was surprising to see Lookery founder Scott Rafer write a blog post announcing his company’s “orderly shutdown”. In heartbreaking detail he took full responsibility for the company’s demise saying, “In chronological order, the sins Lookery committed under my leadership were continuing our dependency on a large partner, not knowing when to cut bait on a failing asset, and building ahead of the market.” While Rafer is still advising half a dozen startups and API management company Mashery continues to thrive, the loss of Lookery has taught the entrepreneur some hard lessons.

“It’s important for a company to exist at all,” said Rafer, “But once you’ve gained some traction you should work to reduce your dependencies.” With Lookery, Rafer’s company was completely dependent on working within the Facebook ecosystem. Said Rafer, “I’ve ranted for years about how bad an idea it is for startups to be mobile-carrier dependent. In retrospect, there is no difference between Verizon Wireless and Facebook in this context.”

After realizing that Facebook would not release anonymized data in a timely fashion, the CEO changed the scope of development. The team first began cloning the Facebook targeting system and then sold the network to build out Lookery’s universal cookie mechanism. Rafer admits that this second project was created well before the market demanded it. Since announcing plans to close down Lookery, the entrepreneur offers sage advice to others.

Lessons Learned: Advice to Others

1. Ramen Profitable: Rafer maintains his belief in the “ramen profitable” model of business. He says, “If you can, bootstrap for as long as possible. You need to build something solid and meet those needs first. Then try to postpone fundraising until you’ve got scaling issues, not survival issues.”

2. Understand Expectations: As a precaution for those who do take on funding, Scott Rafer explains, “You need to know what you owe your investors. If you’ve already built on one platform, do you owe it to them to build elsewhere? Know their expectations before you take their money.”

3. Gain Control: Rafer believes that one way companies with largely Facebook-based audiences can mitigate risk, is to utilize Facebook Connect. This way they can gain access to at least a portion of users in the event of a devastating platform change or alteration to the terms of service. Says Rafer, ” Basically you need to exist first and then think about how you’re going to get out from under the thumb of a single entity.”

Photo Credit: David Sifry and Boris Veldhuijzen van Zanten