There is a lot of chatter in the blogosphere about the recent $100 million investment in Twitter at a $1 billion valuation, but most of it based on speculation. Twitter and Facebook are private companies. You cannot get the facts simply by typing a stock symbol into Yahoo Finance. Our mission at ReadWriteWeb is to add to the facts, not just the speculation. Rather than posting confidential information that someone has leaked to us, we prefer to start with publicly available data. That takes a lot of leg work and crawling through regulatory filings. Luckily, a firm in this industry does that professionally: the VC Experts Valuation and Terms database. It has given us access to and permission to publish the investment facts, as publicly recorded, for both Twitter and Facebook. We could not refrain from a bit of game theory speculation on how this could play out, and we invited a specialist in startup deals to add his speculation as well. But let’s start with the facts.

The Twitter Rounds of Investment

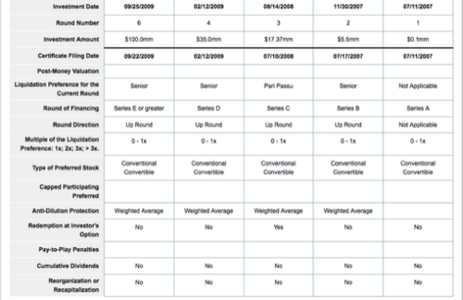

The Facebook Rounds of Investment

Data courtesy of VC Experts Valuation and Terms database.

Our Theory on This Investment and Twitter’s Game Plan

These high-profile deals have “optics” (i.e. the PR or headline story for public consumption) and fundamentals (i.e. how the investors actually make money). They are very different.

The key to the fundamentals is the Liquidation Preference. We touched on this in one of our “Startup 101” chapters: How to Scale Without Losing Your Shirt. Basically, upon exit, the investors get their money out before the entrepreneurs do. That’s reasonable. For example, the Twitter team has not actually built a business worth $1 billion; it is only saying it can do so (with some credibility).

So, the investors putting in $100 million have their risk (or downside) covered. The only way they can lose money is if Twitter sells for less than $100 million, which is pretty unlikely… not impossible, but unlikely. But if it sells for $100 million, then all of the other investors lose everything. The exit valuation has to be higher than $157.97 million (total money invested) for the founders and management team to see a dime.

So, with their downside covered, investors can focus on the upside. This is where optics matter. With this deal, the entrepreneurs can say the following to any potential acquirers:

- “Negotiations have to start at $1 billion. It clearly cannot be lower than that,” and

- “We have a long runway. If you don’t do this deal now, the price will only be higher later.”

In this case, the optics are critical. Although the investors in this latest round have protected their downside, they won’t see any upside unless the exit valuation is greater than $1 billion. By putting in a large amount (which they cannot really lose), the investors help to ensure that the exit valuation is high.

Ideally, Twitter will exit before revenue, when revenue potential is unlimited. As soon as actual revenue comes in, three bad things happen:

- Acquirers say, “Let’s wait and see how this pans out.”

- Costs go up: you have paying customers who demand real service.

- Revenue targets may go south. Exponential hockey-stick growth is hard enough for a free service (kudos to Twitter for doing that brilliantly) but way, way harder when money changes hands. Real money (not investment money) paid by someone to Twitter becomes friction. Twitter ceases to be a friction-less flywheel.

Twitter does have enough cash now to execute on a revenue plan and outlast acquirers who like to sit on the fence. So any way you look at it, this is a smart deal. It is not “evil”: this is all business between consenting adults. Evil would be selling stock to “widows and orphans” in the public market who (A) don’t have Preference and (B) don’t have the means to evaluate the risk on a deal like this. That was Bubble 1.0, and it won’t happen again. This is not Bubble 2.0. This is fundamentally different, even if the optics may look similar.

So What Do the Investment Facts Say?

Enough about theory, what do the facts tell us?

- Yes, the Series E investors (the ones that just put in $100 million) get Liquidation Preference. Look at the line for the current round that says Liquidation Preference. If it says “Senior,” then they get their money out first. If it says Pari Passu, then all investors get their money out equally (i.e. all investors get their money out before the founders and managers).

- But they get only 1x Preference. They don’t get money back plus interest. Nor do they get 2x or 3x. Hint to entrepreneurs: any time you see 2x or 3x, run a mile!

What Is the Difference With Facebook?

All of the Facebook rounds are Pari Passu. What that really means is that earlier investors in Facebook have more clout. They have bigger funds and can essentially say, “If you don’t do this, we will.” The small funds that invested in Twitter early on, such as Union Square Ventures (USV), cannot meaningfully invest in a $100 million round without Twitter becoming too big a percentage of their portfolio. But based on the valuation it invested in early on, USV will make out big time on any exit over $200 million.

The Great Facebook vs. Twitter Exit Game

This is high-stakes poker. Facebook has the potential to do an IPO. It has enough revenue and has at least neutral cash flow. With its actual finances not being in the public domain, we don’t really know how good Facebook’s finances are and therefore cannot know how ready it is to do an IPO. But that’s not a problem; it has enough cash in the bank to wait until it’s ready.

So, any company that really wants to buy Facebook and keep it from doing an IPO will have to pay big time. Only two acquirers are motivated enough and big enough to do this: Google and Microsoft.

Where does that leave Twitter? The $100 million round helps a lot. It is for show, not for spending. It has enough cash for negotiating clout. Facebook would cost Google or Microsoft way more than Twitter. If one of them bought Facebook, Twitter would be even more valuable to the other.

If Facebook does an IPO, Twitter’s valuation would go up based on that public market comparable.

We cannot bet on this in the public markets, so we can only have fun watching the game.

How Does Perception of the Founders’ Motivations Influence the Game?

In poker, perception matters. What you think the other person will do affects how you play your hand.

The exit valuation depends in part on how credible is the founder’s drive to remain independent. Do acquirers really believe the founders are sincere in their stated desire to remain independent by going all the way to IPO? If the acquirer believes that the founder’s desire to remain independent is very strong, then it will raise its bid. So, who does the market see as being more driven to remain independent: Mark Zuckerberg of Facebook or Ev Williams and Biz Stone of Twitter?

We asked Greg Boutin of Growthroute Ventures to comment on this part of the game. This is what he had to say:

“My perception of Ev Williams/Biz Stone is that they are not in it for the journey, but for the destination. Any way I look at it, those guys are not geek visionaries with a mission; they are money-driven. They’ll flip Twitter to the highest bidder, if there is one. They know everyone is questioning Twitter’s potential for revenue creation, and the hype effect will die out in a matter of months. Twitter has mostly unfolded during the crisis; being in SF has sure influenced their thinking. And unlike Facebook with its platform status, it really has only so many options to create revenue, none of which is likely to support the valuation.”

Greg thinks that Mark Zuckerberg is a different story:

“Zuckerberg strikes me as someone who is driven less by the money – especially now that Facebook is turning a profit – than by the visceral “geek need” to prove he’s smarter. He’s demonstrated a strong desire to grow Facebook into the next big thing and I’d say even challenge Google for domination of the Internet.”

Greg is willing to stick his neck out and make a prediction: “Twitter will sell next year for $2.5 billion to Google (or some other company that can come up with that kind of money). And Facebook will IPO.”

He also thinks the high price will be based on non-rational factors: “They want to acquire it for the trophy factor, like top lawyers fighting to get the most expensive downtown offices. It’s an ego and brand thing.”

What Insights Do You Get from This Data?

We hope that people who are better qualified than us can describe what is significant in these deal terms, apart from the obviously high valuation.

What jumps out at you from this data? How do you think this will play out?